Crude Oil

Oil prices slipped on Monday as Wall Street slid more than 1 percent and energy market investors remained wary of growing crude supply, although tensions between Saudi Arabia and Iran gave prices some support. Brent crude futures dropped 16 cents to settle at $66.05 a barrel. WTI eased 28 cents to settle at $62.06/bbl. The WTI crude future for April expires tomorrow.

A 0.25% rate hike is expected when the FOMC meets later today. indices, led by tech stocks, also suffered their steepest fall in more than a month. The Fed’s meeting will last two days and conclude on Wednesday in the US.

JODI (Joint Organisations Data Initiative) data for January 2018 was released yesterday. Some highlights are given below.

- Saudi crude exports rose 1.8% m/m to 7.045 mb/d, with output remaining largely flat. More notably, diesel and gasoline exports soared to a record of 1.912 mb/ d in January, amid new refinery capacity in recent years. Exports of kerosene were also at a record.

- Nigerian crude output climbed 4.3% y/y to 1.96 mb/d. Exports surged 22% as refinery intake remained 44.3% lower y/y.

- Iraq crude exports fell 2.1% m/m to 3.839 mb/d, with output largely flat.

Naphtha

Asia’s naphtha crack eased further on Monday to $83.35 /MT as Naphtha prices failed to rally along with crude. However, cash demand remains strong with reports of 1st half may cargoes being concluded at premiums of $ 11-12 / MT over marker quotes CIF Japan.

The April crack has dropped to $ 0.15 /bbl

Gasoline

Asia’s gasoline settled close to $8 /bbl at $ 7.98/bb. While this is nearly a two week high, it is 10.2% lower than a year ago.

The April crack is lower at $ 11.45 /bbl

Distillates

Asia’s jet fuel price premiums edged up on Monday, ending six consecutive sessions of losses. Jet fuel cash premiums were at 21 cents a barrel to Singapore quotes, compared with 19 cents in the previous session, which was the lowest in nearly two months. . Meanwhile, the cash differential of Asia’s 10ppm gasoil rose 1 cent to 28 cents a barrel to Singapore quotes.

The April gasoil crack has firmed up to $ 14.45 /bbl with the 10 ppm crack at $ 15.10 /bbl. The regrade is at -$ 0.15 /bbl.

Fuel Oil

Asia’s 380c-st cash differential slid into a wide discount on Monday amid an absence of willing buyers despite aggressive suppliers for cargoes of the fuel. 380-cst fuel oil cash discounts fell to minus $1.17 a tonne to Singapore quotes on Monday, down from a premium of 5 cents on Friday and plus 17 cents a week ago. The 380-cst cash differential is now at its lowest since March 2017.

The April 180 cst crack has dropped to -$ 4.85 / bbl with the visco spread at narrowing slightly to $ 1.20 /bbl

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

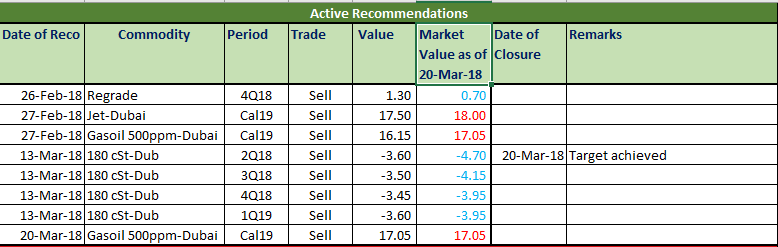

We have reached our target levels in the Fuel Oil Crack for 2Q 2018.

Gasoil cracks for 2019 are strengthening steadily. We would recommend adding a further hedge in Cal 19 Gasoil/Dubai crack at $ 17.05 /bbl. Gasoil last settled above $ 17 /bbl in January 2015.

Today’s status of active recommendations is below.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.