Crude Oil

Oil prices jumped on Friday as traders focused on possible disruption in supplies due to political tension in the Arab Gulf. Brent futures rose $1.09 to settle at $66.21 /bbl. WTI gained $1.15 to settle at $62.34/bbl. The WTI crude future for April expires tomorrow.

Remarks on Thursday by Saudi Arabia’s Crown Prince Mohammed bin Salman added to geopolitical tensions after he warned that his country would seek to develop a nuclear bomb if Iran did.

The fate of Iran’s nuclear deal looks grim with the incumbent Secretary of State, Mike Pompeo well aligned with President Trump on its scrapping.

On the bearish side, the number of active rigs climbed back to 800 as per the Baker Hughes weekly report.

Hedge funds and other money managers cut their bullish bets on U.S. crude oil futures and options in the week to March 13, as crude prices fell for a second week. The speculator group cut its combined futures and options position in New York and London by 24,667 contracts to 453,864 during the period. The cuts marked the second consecutive week in which speculators cut their net long positions in the market.

![]()

19 March 2018

Friday Makes the Week

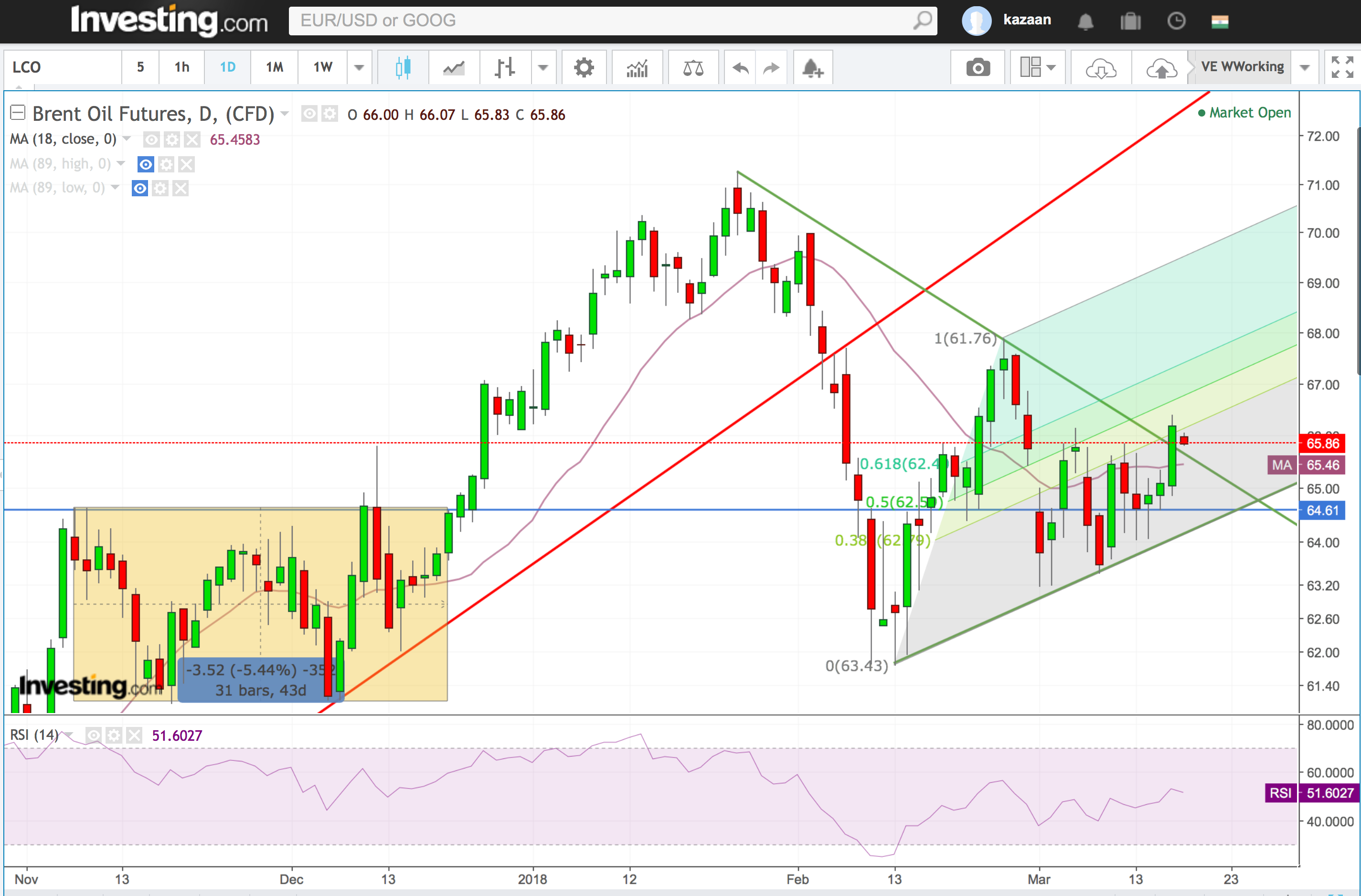

After trading for the whole week in a narrow band, Brent broke out on Friday from a a narrowing range of reducing amplitude to close at 66.21. This 12 day high gives us the first signal of a move to the upside.

Ideally we should wait to see the move follow-through to take a long trading view. This comes with a close above 66.50. This follow-through in buying to Friday’s move is important to confirm, as in the 12 days past, the previous 2 attempts at 66+ have failed. Also the latest move is not backed by expanding momentum..

If the move is confirmed, then the strategy would be to go long at these levels with a stop around 64.50 with upsides to the 67.50 – 68.00 range.

Supports and Resistances

Immediate resistances are at $ 66.00 and then $ 67.00 areas.

Immediate supports are in the 65.20-40 area and then in the $ 63.80- 64,00 range.

Naphtha

Asia’s naphtha crack eased on Friday to $84.60 /MT. While demand is expected to be strong going forward, the easing was attributed to most buyers having completed their purchases for the second half of April. This week will probably give more definition to the future of the crack.

The April crack has risen further to $ 0.95 /bbl

Gasoline

Asia’s gasoline crack edged up 14 cents to $7.88 /bbl but supplies in both Singapore and Europe were seen high. Gasoline stocks in the ARA hub rose to 1,309 KT last week. The weak fundamentals have even prompted at least three 90,000 tonne tankers being booked in recent weeks to store gasoline for up to 60 days off the Dutch coasts, according to traders and shipping data.

The April crack is marginally lower at $ 11.75 /bbl

Distillates

The downtrend in Asia jet fuel market continued on Friday with cash premiums slipping for a sixth consecutive session and the front-month time spreads of the fuel narrowing their backwardated structure. Lower deal values on Friday pulled jet fuel cash premiums 19 cents a barrel to Singapore quotes, down from 34 cents in the previous session and its lowest since Jan. 26.

ARA Gasoil stocks fell to 2,980 KT while Jet stocks fell to 563 KT. While gasoil stocks were 3% lower than the previous year levels, jet stocks were around 12% lower.

The lower gasoil stocks came amid strong inland demand drawing barges from ARA.

The April gasoil crack has eased to $ 14.15 /bbl with the 10 ppm crack at $ 14.85 /bbl. The regrade is at -$ 0.05 /bbl.

Fuel Oil

Steady arbitrage supplies into Singapore weighed on the East-West (EW) arbitrage spread this week which on Friday slipped to a one-week low as suppliers locked in more volumes from the European oil hub for delivery into Singapore. At least two very large crude carries (VLCCs) have been chartered this week to ship fuel oil from the Rotterdam oil hub for discharge into Singapore.

ARA fuel oil stocks plummeted by 364 KT to 725 KT, largely attributed to the movement of stocks to Singapore.

The April 180 cst crack has dropped to -$ 4.55 / bbl with the visco spread at $ 1.25 /bbl

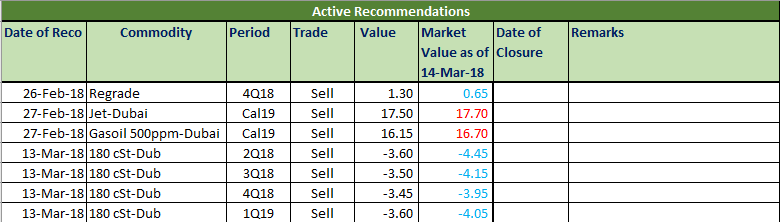

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.