Crude Oil

Oil prices edged higher in choppy trade on Thursday after the International Energy Agency said global oil demand is expected to pick up this year, but warned supply is growing at a faster pace. Prices notched their second consecutive day of gains, as both Brent and WTI closed 23 cents higher at at $ 65.12 /bbl and $ 61.19 /bbl respectively.

The market is caught in between pressures caused by the OPEC production cuts, which has succeeded in dropping free floating stocks to 5 year averages for crudes and significantly lower for products as well, and rising US crude production which is expectedto be more than sufficient for demand growth this year.

The other significant factor making the market bullish is the strong economic recovery in the US, already reported to be the third longest in history and the impact it may have on demand over there. This is arguably providing the most significant support to prices in the current scenario.

Naphtha

Asia’s naphtha crack rose for a second day on Thursday to reach a near two-month high of $87.55 /MT. Cash premiums are expected to remain at around $ 10 / MT

The March crack has improved to $ 1.35 /bbl while the April crack has also risen to $ 0.60 /bbl

Gasoline

Asia’s gasoline crack was at a four-session high of $7.74 a barrel but supplies in Singapore were seen high, although U.S. demand has picked up. Singapore’s light distillates stocks, which comprise mostly of gasoline and blending components for petrol, edged up 2 percent or 293,000 barrels to reach nearly a 3-1/2 month high of 14.87 million barrels in the week to March 14.

The March 92 Ron gasoline crack has improved further to $ 11.75 /bbl. The April crack is higher as well at $ 11.85 /bbl

Distillates

Asia’s front-month jet fuel crack to Brent crude slipped to a two-session low on Thursday as seasonal heating demand continues to fade and supplies build. The April jet fuel crack slipped to $14.47 a barrel, down 12 cents from the previous session and near a two-month low of $14.12 a barrel reached on Tuesday. The downtrend in jet fuel was also apparent in its cash premium, which fell for a fifth straight session to 34 cents a barrel to Singapore quotes, its lowest since Jan. 29.

Singapore onshore middle distillate stocks fell to a two-week low of 8.958 million barrels in the week to March 14, down 4 percent from the previous week. Since the start of the year, Singapore middle distillate stocks averaged 9.270 million barrels a week, compared with a weekly average of 11.963 million barrels in 2017

The March paper gasoil crack has risen to $ 15.05 /bbl. The 10 ppm crack is at $ 15.60 /bbl. The March regrade has fallen to $ 0.55 /bbl.

The April gasoil crack is unchanged at $ 14.30 /bbl with the 10 ppm crack at $ 15.00 /bbl. The regrade has slipped into negative territory and is valued at -$ 0.25 /bbl.

Fuel Oil

Asia’s front-month 380-cst fuel oil time spread and crack edged lower on Thursday amid limited trading activity. The April/May time spread was slightly lower on Thursday, trading at about 65 cents a tonne, remaining within a tight range of about 60-90 cents a tonne this week. Similarly, the front-month 380-cst fuel oil crack to Brent crude was trading at about minus $10.50 a barrel during the Singapore trading window on Thursday, down from minus $10.30 a barrel in the previous session.

This came as Singapore weekly onshore fuel oil inventories jumped 8 percent, or 1.84 million barrels (275,000 tonnes) to a 2018 high of 23.871 million barrels (about 3.56 million tonnes) in the week ended March 14.

The March 180 cst crack has weakened further to -$ 3.80 /bbl. The visco spread is steady at $ 1.25 / bbl.

The April 180 cst crack is -$ 4.15 / bbl with the visco spread at $ 1.20 /bbl

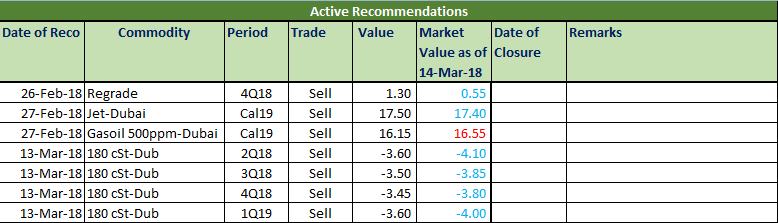

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.