Crude Oil

Oil prices had a surprisingly muted reaction to what was apparently bullish data released by the DOE. Brent futures settled 7 cents lower at $69.31 /bbl while WTI eased 2 cents to $63.95 per barrel.

The reaction was even more surprising since Cushing reported the largest draw down since 2004.

OPEC’s monthly report showed that production remained largely flat at 32.4 mb/d in December. Output growth from Nigeria (+76 kb/d) and Angola (+45 kb/d) were mostly offset by declines from Venezuela (-82 kb/d). The cartel raised its supply outlook for its US rivals again and estimated that 2018 non-OPEC supply growth will be some 121 kb/d. On the demand-side, OPEC raised its 2018 world demand forecast by 60 kb/d to 98.51 mb/d (i.e. +1.53 mb/d year on year).

DOE Data

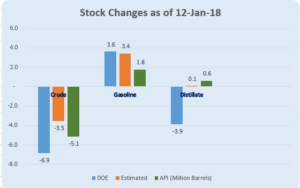

The DOE reported a draw of 6.8million barrels in its weekly report published yesterday. Not only was this higher that the expectation of 3.5 million barrels, but also higher than the API reported figure.

The DOE reported a draw of 6.8million barrels in its weekly report published yesterday. Not only was this higher that the expectation of 3.5 million barrels, but also higher than the API reported figure.

While Gasoline built by 3.62 million barrels. Distillate stocks reported a surprise draw of 3.89 million barrels.

Stocks at Cushing dropped by 4.2 million barrels. This Cushing move is in line with ‘disappointing’ production figures showing the recent disruptions of US domestic production were severe and are not really over. On the brighter side, domestic crude oil production returned to 9.75 mb/d.

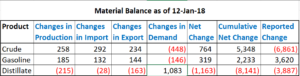

The material balance of the data poses a lot of questions though if we try to reconcile the figures. In the first place, refinery runs came down to 93.0% from 95.3%. While distillate production decreased by 215 kb/d, gasoline production increased by 185 kb / d! This data is perplexing really. Crude Production increased by 250 kb / d, Net crude imports increased by 60 kb/d, Crude consumption decreased by 450 kb/d all of which should have led to a massive build in crude stocks instead of the reported massive draw.

Distillate demand rose by a healthy 1.1 mb/d

Naphtha

Although the Asian physical naphtha crack settled at a six-day high of $ 92.32 /MT on Thursday, sentiments continue to be bearish on expectations of high volumes of naphtha coming to Asia from the West and improving economic feasibility of using LPG as an alternate feedstock to naphtha.

The naphtha crack which had slipped below $ 1.00 /bbl last week has managed to climb back up today and is valued at $ 1.15 /bbl for February

Gasoline

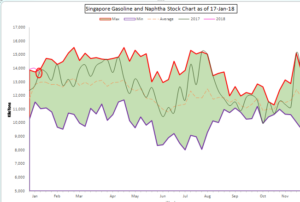

The Asian physical gasoline crack also increased on Thursday settling at a five-day high of $ 7.66 /bbl arguably supported by the drawdown in Singapore’s onshore light distillates which fell 3.2 % or 442,000 bbls to a three-week low of 13.55 million bbls in the week to 17 January 2018. This fall notwithstanding, inventories remain well over the five year average and towards the upper end of the range.

The February crack has further improved to $ 12.00 /bbl.

Distillates

Distillate cracks continue to be valued higher even as inventories rose in Singapore with traders expecting gasoil demand in China to be subdued with the upcoming Chinese New Year. Singapore onshore middle distillate stocks rose 3.5 % to a five-week high of 10.331 million bbls in the week to 17 January 2018.

The February gasoil crack is higher at $ 14.65 /bbl with the 10 ppm crack at $ 15.70 /bbl. The February regrade has come down further to $ 0.35 /bbl on account of slowing demand for spot cargoes.

Fuel Oil

The fuel oil cracks are valued higher for a third straight day as some additional spot demand helped prop up the market.

Singapore’s weekly onshore fuel oil inventories rose 1.7 % to a two-week high of 19.999 million bbls in the week ended 17 January 2018.

The February 180 cst crack has improved to -$ 5.30 /bbl. The visco spread has also increased to $ 0.75 / bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity