Crude Oil

Oil prices pulled back yesterday as basic fundamentals of oversupply continued to worry the markets. Brent futures gave up 54 cents to settle at $ 64.95 /bbl. WTI fell 66 cents to settle at $ 61.36 /bbl.

China’s NEA has set its 2018 crude production target at 3.82 mb/d, largely unchanged from 2017 output. This implies that China must arrest the decline in output that has happened over the past few years, with output falling 4% y/y in 2017 and 6.9% y/y in 2016.

Venezuelan foreign minister Jorge Arreaza said in New Delhi on Monday that the country would like to accept payment from India in Indian rupees which it will then use for its purchases from India. The objective of this arrangement would be to circumvent sanctions imposed by the US, if any. A similar arrangement was reached between Iran and India at the height of the sanctions regime on Iran. Venezuela is India’s second largest supplier.

CFTC data

CFTC data suggesting that funds are continuing trimming their net length would have also added to sentiment. Hedge funds reversed their positions in the 6 most important futures and options contracts linked to petroleum prices by around 50 million barrels in the week to March 6. This largely reverses the increase in positions of 68 million barrels in the previous week.

The largest trimming of positions was done in Nymex WTI (17 million barrels) and European Gasoil (13 million barrels). Net length in Brent reduced by 5 million barrels.

While the funds still retain their extremely bullish stance; at a net length of 1.24 billion barrels, a ratio of 10 long positions for every short position, we have seen short positions record an increase for the first time in several weeks.

The ratio of 10.0 is lower than the record ratio of 11.90 long positions at the end of January 2018, but it still represents a serious liquidation risk to the downside and is likely to pull down any serious rally in the immediate future.

Naphtha

Asia’s naphtha crack recovered marginally to $79.90 / MT on Monday with little fresh news to move traders either way.

The March crack, though, has dropped lower to $ 0.55 /bbl. The April crack has flipped into negative territory at -$ 0.15 /bbl

Gasoline

Asia’s gasoline crack to Brent fell even further $ 7.42 /bbl yesterday extending its losing streak to 8 sessions. Not even a fire at CPC’s 350 kbpd Talin refinery could infuse a bullish sentiment into the market.

Iraq hopes to reduce refined products imports by 25% this year due to the reopening of several refineries, according to the oil minister on Monday. The refineries were mostly shuttered after they were damaged by Islamic State militants in 2014.

The March 92 Ron gasoline crack has nevertheless improved to $ 11.15 /bbl. The April crack is higher as well at $ 11.25 /bbl

Distillates

Asia’s jet fuel cash premiums extended losses on Monday, falling to a near five-week low as slowing seasonal demand weighed on bullish sentiment that boosted the jet fuel market to multi-year highs since the start of the year. Japanese demand for the middle distillate fuel for the remainder of March still prevalent in the market but its imports of the fuel in April was so far seen as limited due to ample supplies and receding winter demand.

Meanwhile, sustained buying interest for physical cargoes of 10ppm gasoil helped firm cash differentials of the fuel to its widest premium in a month at 20 cents a barrel on Monday, up from an 18 cents a barrel premium on Friday and a 2018 low of minus 6 cents a barrel in the previous week.

The March paper gasoil crack has dropped to $ 14.50 /bbl. The 10 ppm crack is correspondingly lower $ 15.05 /bbl. The March regrade is marginally lower at $ 0.95 /bbl.

The April gasoil crack is at $ 13.90 /bbl with the 10 ppm crack at $ 14.55 /bbl. The regrade is at $ 0.05 /bbl.

Fuel Oil

Cash differentials of Asia’s 380-cst high-sulphur fuel oil slipped on Monday as some suppliers accepted lower premiums for cargoes of the fuel. The 380-cst cargoes were sold at a premium of about 7 cents a tonne to Singapore quotes in front-end of the Singapore trading window on Monday, down from the premiums of about 35-60 cents a tonne paid for similar cargoes on Friday in the front and middle of the trading window.

Global executives and traders are bracing for higher volatility in fuel markets as they expect refiners to process more light crude oil in the lead-up to new rules aimed at slashing the use of dirty high-sulphur fuel oil in global shipping. The IMO rule changes will likely prompt refiners to boost processing of sweeter crude grades because they produce cleaner, low-sulfur fuels.

The March 180 cst crack has strengthened sharply to -$ 3.30 /bbl. The visco spread is at $ 1.20 / bbl.

The April 180 cst crack is -$ 3.65 / bbl with the visco spread at $ 1.20 /bbl

The 180 cst crack has strengthened considerably over the past couple of weeks in the face of weak demand. We would therefore recommend a small hedge the April 180 cst crack at these levels right out to 1Q19 with the option of adding should levels improve further. For reference, the crack has settled below these levels only 30% of the times in the last 5 years.

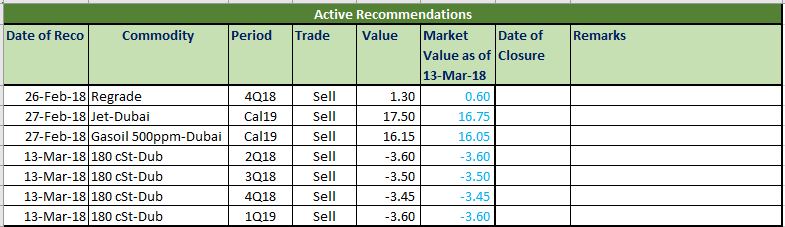

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.