Crude Oil

Oil prices continued to fall on Thursday making two week lows on settles. Brent futures fell by 91 cents to settle at $ 63.83 /bbl. WTI lost 65 cents to settle at $ 60.99 /bbl.

The sentiment in the market continues to stay bearish notwithstanding the continued fall in stocks at Cushing. At below 30 million barrels, these levels are the lowest since the last week of 2014. Notwithstanding this drop, crude oil stocks rose in the US last week.

Good compliance by the OPEC is also not attracting as much attention as it used to in the past. A Reuters survey reported that production in the OPEC fell to a 10 month low in February.

OPEC is hosting a dinner for the shale oil firms in Houston on Monday to discuss how to control the global oil glut. US oil companies technically cannot participate in any ‘production cuts’ as they could be sued for collusion. Therefore, if OPEC wishes to have its way, its path will be cut out to control oil prices the way it has been wanting to.

Naphtha

Asia’s naphtha crack continued its rise, settling at $ 80.40/MT on Thursday. Expected arrivals from Europe for the March are of the order of 1 million tonnes. This is steeply lower than the 1.4 million tonnes delivered in each of the first two months of the year.

The March crack has zoomed to $ 1.20 /bbl

Gasoline

Asia’s gasoline crack to Brent eased by 2 cents to $8.62/bbl on Thursday. Singapore light distillate stocks fell again this week to just above 13 million barrels. For latest details on stocks in all regions click here. While stocks in Singapore have dipped to just below the 5 year average, they appear to be adequate in other regions of the globe.

The March 92 Ron gasoline crack has improved to $ 11.85 /bbl

Distillates

Prompt jet fuel derivatives price increased on Thursday, as spot demand from Japan boosted the market. The backwardation between March and April prices widened on Thursday reflecting this strength. Japan’s imports of jet fuel jumped to about 10 to 12 medium-range sized cargoes as refineries maximised production of heating fuel kerosene at the expense of jet fuel.

Singapore middle distillate stocks fell by nearly 200 kb to 8,920 million barrels. While Indonesian imports from Singapore jumped nearly five time to above 700 kb, their effect was mitigated by increased Chinese exports to Singapore of over 900 kb in the month of February

The March paper gasoil crack has increased marginally to $ 14.30 /bbl. The 10 ppm crack is at $ 14.85 /bbl. The March regrade continues to blow out and is at $ 2.95 /bbl today.

Fuel Oil

Asia’s front-month viscosity spread continued to hold steady on Thursday at $7.50 /MT.

Singapore Fuel Oil Stocks rose by nearly 1.1 million barrels to 22.53 million barrels in the week to February 28. This was even as Fujairah stocks fell to a record low of 4.84 million barrels in the previous week.

The March 180 cst crack has further strengthened to -$ 3.75 /bbl. The visco spread has stayed at $ 1.15 / bbl.

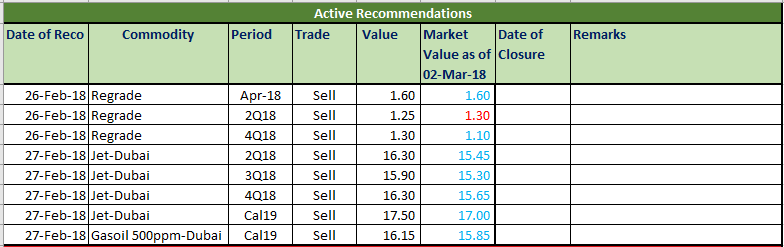

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.