Crude Oil

Oil prices recovered a bit on Friday aided by a weak US Dollar and a late afternoon recovery in stock markets. Brent futures gained 54 cents to settle at $ 64.37 /bbl. WTI also gained 26 cents to settle at $ 61.25 /bbl.

During the US trading day however, crude spent most of the time in the negative zone after President Trump said he would levy tariffs on aluminium and steel imports causing investors to fear a trade war.

Despite Friday’s bounce, Brent lost 4% during the week and WTI 3.6% as investors watched rising US production with some worry.

The number of active drilling rigs increased by 1 last week to touch 800 according to Baker Hughes in its widely followed weekly report. This is the sixth straight week of increases although the last two have been of 1 rig each.

In other news, Libya’s Sharara oil field halted production on Sunday after closing a pipeline to the Zawiya refinery. The field is Libya’s largest, and had been contributing around 300 kb/d to the country’s total production. Details on the cause and duration of the production halt remain scant at the moment.

Today, the 37th annual CERAWeek Energy conference starts in Houston, Texas. OPEC will be hosting a dinner for shale oil producers in the evening.

![]()

Prices pulled back from the 61.8% retracement level with an inability to sustain above the 50 day moving average. We are currently trading around the 100 day moving average which may well be an immediate resistance. While the RSI is still showing a mildly oversold position, the MACD seems to be poised for a crossover in the daily charts

On the weekly charts though, the MACD continues to be bearish going further into negative territory even through the last two weeks of pullback.

The charts overall continue to show signs of bearishness

Trade for the week would be to sell short here with a stop above $ 65.40 targeting the previous low at $ 61.77. A more cautious trade would be to sell a bit higher at around $ 66.5 with a stop above $ 67.20. The counter intuitive trade would be to buy at these levels looking to reverse around $ 66.5 with a stop below $ 63.80

Supports and Resistances

Immediate resistances are at current levels which is the 100 DMA followed by $ 65.40 and then $ 66.50 areas.

Immediate supports are 63.80 and the 63.20 area before a strong support in the $ 61.80 range.

Naphtha

Asia’s naphtha crack is firmly in recovery mode, settling at a one month high of $ 82.70/MT on Thursday. Cargo arrivals from the West in the month of April are also expected to be low leading to better prices. Demand has also increased due to turn arounds in refineries in China (Formosa), India (IOC – Paradip), Japan (JXTG – Kawasaki) and South Korea (S.K. Energy).

However, offsetting these shutdowns is the shutdown of naphtha crackers in Japan (Showa Denko and Tosoh) which could reduce demand by around 300 MT per month.

In the meanwhile, Naphtha stocks in ARA eased marginally last week to 308 KT

The March crack has increased to $ 1.40 /bbl

Gasoline

Asia’s gasoline crack to Brent continued to slip marginally, settling at $8.56/bbl on Friday i.e. 6 cents lower. Gasoline stocks in ARA eased by 1.4% to 1.323 million tons. However, these levels are 17% higher than the previous year. For latest details on stocks in all regions click here.

The March 92 Ron gasoline crack has improved to $ 12.25 /bbl

Distillates

The jet fuel cash differential slipped from multi-year highs on Friday as temperatures in Japan rose, indicating winter demand may ease. Japan is set to import 10 to 12 medium-range cargoes of jet fuel in February, likely the highest on record due to a cold winter and refinery maintenance curbing supply. But with the temperature rising late this week, imports of jet fuel could slip to four to five cargoes in March and exports of the fuel may resume in April.

The March paper gasoil crack is marginally lower at $ 14.20 /bbl. The 10 ppm crack is at $ 14.75 /bbl. The March regrade has eased to $ 2.50 /bbl today.

Fuel Oil

Asia’s front-month viscosity spread climbed 25 cents back to $7.75 a tonne, the eight-month high achieved earlier this week. Fuel oil inventories have fallen significantly in Europe and Fujairah. Fuel oil stocks held at the Amsterdam-Rotterdam-Antwerp refining and storage hub fell by more than 23 percent to reach an 8-1/2 month low of 775,000 tonnes in the week to March 1. The drop in stock levels were due to rising exports to Singapore

The March 180 cst crack has marginally weakened to -$ 3.95 /bbl. The visco spread has increased to $ 1.20 / bbl.

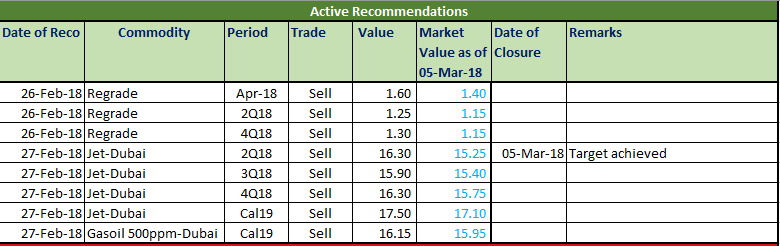

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.