Crude Oil

Crude prices jumped up by 2.7%-3% in a move that could possibly have caught the market by surprise. The expiring Brent October future gained $ 1.52 to settle at $ 52.38 /bbl. The November future, which becomes front month today, gained $ 1.11 cents to settle at $ 52.84/bbl. WTI gained $ 1.27 cents to settle at $ 47.23 / bbl.

There was no significant news to account for this price rise. Therefore, the primary factor appears to have been the rise of products prices in the US pulling up crude prices. This is in consonance with our theory that the spike in cracks is for a strictly limited time. The other possible factor could have been the end of the month effect on prices.

Having stated the above, there are signs that the market is preparing to help ease out the situation. The US government plans to release 1 million barrels of crude from its Strategic Petroleum Reserve to Phillips 66’s Lake Charles refinery. Also, the ports of Houston, Texas City, Galveston and Freeport reopened yesterday with a few restrictions (This information courtesy Vandainsights).

Products

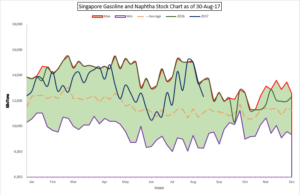

With Singapore closed today for Bakri Eid, there are no product prices available in Asia this morning. However, we will share with you some highlights of stock data in both Singapore and ARA.

Gasoline

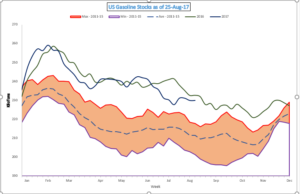

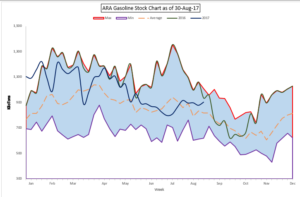

Gasoline prices in the US have rocketed off the charts pulling up with them not only crude, but also product prices in other parts of the world. With the weekend coming up, it is time to take stock (literally) of the situation.

On Monday morning, we had shared with you the status of stocks in all three major centres. We present below an update of the status a week later.

A quick look at the stocks in all the centres would suggest that there may not be any need for a panic about long term availability of product in the market.

Hence, strategically, it would be a good idea to hedge gasoline cracks beyond the September (we would recommend September as well) if they persist at current or better levels. In our experience, this will be beneficial in the long run.

Fuel Oil

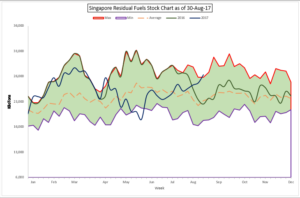

The high levels of Fuel Oil cracks have always been a puzzle to us. Fuel Oil Cracks have been continuously strong since around October 2016. The reasons have been multifarious; There will be less production of Fuel Oil with more refineries. The absence of cutter stock for appropriate specs. The upcoming impact of Marpol etc.

While the absence of cutter stock would have been genuine, we need to examine the possibility of limited supplies.

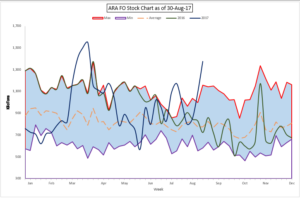

Barring a small period in June 2017, when stocks had touched their lowest levels in a while, Fuel Oil stocks have always been fairly comfortable all through 2017.

In Singapore, the most significant report was the increase in Fuel Oil stocks by 1.61 million barrels. Fuel Oil stocks are now at their highest level for this time of the year. Reuters reports that Fuel Oil cracks eased post this data.

With Fuel Oil stocks in the ARA reporting extremely high levels as well, we believe that the Fuel Oil cracks are at unreasonably high levels for now. We would recommend the hedging of Fuel Oil going forward if levels like those seen during the past week are available. Even if these hedge positions may suffer tiny losses, the ratio of reward to risk appears tremendously attractive.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity