Crude Oil

Crude prices stayed virtually unchanged on Friday. The November future, which became the front month today, lost 9 cents to settle at $ 52.75/bbl. WTI gained 6 cents to settle at $ 47.29 / bbl.

Gasoline futures eased out as some refineries started resuming operations which led to a further calming of tension. Of the estimated 4.5 mb/d capacity shut down by Harvey, it is expected that 1.1 mb/d or about 25% should be back online by tomorrow.

The US government authorised the release of a further 3.5 million barrels to other refineries over the weekend.

For the week, WTI lost 58 cents while Brent gained 34 cents. WTI posted losses for the fifth week in a row. However, given the turmoil in the markets over the last week or so, this streak may not continue this week.

The Baker Hughes rig count stood unchanged at 759 last week. Given the figures over the last few weeks, further sustained growth in the numbers seems unlikely.

In other news, North Korea successfully tested a device which it proclaimed was a hydrogen bomb. The detailed impact of this event on the market will only be known tomorrow as the US is closed for the Memorial Day holiday today.

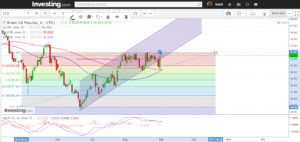

Technical Analysis

Both the daily and the weekly charts suggest a rise in prices this week. On the daily charts, prices broke the 200 DMA and the rising channel only to reenter the channel and close above the 200 DMA this week. We can also see the 50 DMA cross the 100 DMA from below, another bullish signal. The MACD however suggests a mild bearish divergence.

The weekly chart shows 5 consecutive failed attempt to breach the 50 week moving average which underlines the strength of the support line there. Having said so, each of the candles have been virtually spinning tops, indicating uncertainty in the markets as to direction. The strong support suggests that the market tends to believe prices would rise rather than fall from here.

Supports lie at $52.34 (200 DMA), $ 51.80 (50 WMA) and then the $50.90 -$51.00 are which are Fibonacci levels in both the daily and weekly charts. Resistances lie at $ 52.92 (a number of previous highs there so fairly strong), $ 53.64 and then $ 54.67.

Naphtha

The Naphtha cracks continue to strengthen driven by rising premiums in the physical market. India’s Reliance Industries was learnt to have sold 55,000 tonnes of naphtha for Sept. 23-25 loading from Sikka at a premium in the low teens to Middle East quotes. This is significantly higher than a premium of about $9 /mt it got earlier for a similar cargo loading in early September. On the other hand, Taiwan’s Formosa is heard to have bought about 100,000 mt of naphtha for October arrival at Mailiao at a discount of $1.50 to $2 /mt to Japan quotes which is lower than a discount of approximately of $3 /mt it paid earlier for cargoes for delivery in second-half September.

The September Naphtha crack is valued stronger $ 3.15 /bbl

Gasoline

Gasoline cracks, although down from our previous valuation, continue to stay strong as traders reroute millions of barrels of fuel to Latin America to compensate for loss of supplies due to Hurricane Harvey which crippled the U.S. Gulf of Mexico refining hub.

Buyers from Mexico, Brazil, Colombia, Venezuela, Argentina are turning to refineries in Europe, Asia and even the U.S. East Coast in a rush to replace more than 2.5 million barrels per day of fuel imports.

The 92 RON crack for September is valued at $ 16.40 /bbl. Given that refining capacity in the U.S. is now expected to slowly come back onstream post the devastation of Harvey, it may be a good move to hedge gasoline cracks while they are still at these high numbers.

Distillates

Distillate cracks have strengthened further as traders continue to take vessels on subs to ship diesel and jet fuel to the United States from Singapore, South Korea and Japan. Colonial Pipeline Co, the biggest U.S. fuel system, announced that it would shut its main diesel and jet fuel line on Wednesday evening because of outages at its supply points. The pipeline connects the refineries of the Gulf Coast to the populous East Coast, transporting more than 3 million barrels of fuel every day.

The September gasoil crack is stronger at $ 15.40 /bbl. The regrade has slipped to -$0.05 /bbl.

Fuel Oil

Fuel Oil cracks have also risen as spot demand is keeping prices stable. However key trading hubs like Fujairah and Singapore are well supplied and hence cracks are unlikely to rise significantly from here.

The 180 cst crack is valued at -$1.15 / bbl for September. The visco spread is unchanged at $ 0.85 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity