Crude Oil

Crude prices crashed on Wednesday in the face of bearish DOE data. Brent closed $ 1.64 lower at $61.22 /bbl. WTI also lost $ 1.66 to settle at $ 55.96 /bbl

Both crudes lost over 2.5% yesterday. For WTI, it was the largest one day drop in more than two months and the lowest settle since November 16. For Brent it was the lowest settle since November 2. This drop will put something of a dent in market sentiment and cast darker shadows over the pace of rebalancing, if at all any is taking place.

DOE Data

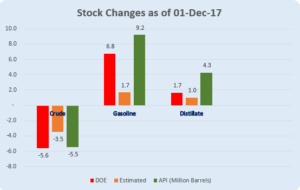

The DOE, in its weekly report yesterday, said that crude stocks had dropped substantially by 5.6 million barrels, but product stocks of gasoline and distillates had built by 6.8 million and 1.7 million barrels respectively.

The product builds wiped the sheen off the crude draw as it was clear that domestic demand is not sufficient to create significant shortfalls in crude. Further, if we consider the impact of the Keystone shut down, the draw is really negligible.

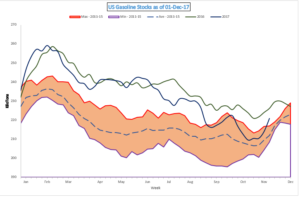

While gasoline stocks typically build at this time of the year, this huge build has pulled them way above the 5 year average for 2011-15 and very close to 2016 stock levels.

While gasoline stocks typically build at this time of the year, this huge build has pulled them way above the 5 year average for 2011-15 and very close to 2016 stock levels.

Gasoline demand has stayed below 9 million barrels per day (8.9 mb/d) disappointingly for the second week in a row. This comes at a time when driving is high for Christmas shopping. It would appear that the impact of Hurricane Harvey on gasoline stocks is now over and stocks have restabilized.

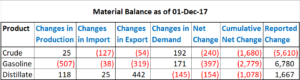

The material balance statement for the week is showing some anomalies in the gasoline figures. As per changes in various components, there should be a draw of 2.8 million barrels rather than a build of 6.8 million barrels.

This continues to remain one of the imponderables in the market.

Naphtha

No fresh news on the Naphtha crack for today.

The December crack for now is higher at $ 4.10 /bbl.

Gasoline

The Asian gasoline crack settled higher on Wednesday notwithstanding the reported build of 9.2 million barrels by API as regional demand for the product offset the bearish news. Gasoline demand in the Middle East is firm on the back of several refinery turnarounds in that region. In addition, demand from the Phillipines, Vietnam and Indonesia is expected to prop up prices.

The December 92 Ron paper crack, is unchanged at $ 11.40 /bbl.

Distillates

Jet Premiums remained steady notwithstanding significantly lower sales of the product in Japan this year. Gasoil appears to be supported with Fujairah distillate inventory levels being reported at a record low for the week to December 4.

The December Gasoil crack though has dropped to $12.70 /bbl. with the regrade at $0.55 /bbl.

Fuel Oil

Fuel Oil cash differentials fell to extremely low levels following aggressive supplier offers in the Platts Window yesterday. Inventory in Fujairah rose to 12.3 million, the highest since July 2017. The crack for December has plummeted to – $ 4.35 for December. The visco spread has narrowed to $ 0.50 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity