Crude Oil

Crude prices dropped drastically as the market eyed the shut down of US refineries with consternation. Brent fell by 52 cents to settle at $ 51.89 /bbl. WTI fell by $ 1.30 /bbl to settle at $ 46.57 / bbl.

As of now, Hurricane Harvey is on a return visit to the area with heavy rains of over 15 inches expected in the Gulf of Mexico area. More than 13% (around 3.4 Mb/d) of the USA’s refining capacity has been shut down due to the storm. Around 330 KBD (approximately 19%) of the Gulf of Mexico’s crude oil production has been shut down.

The market has read the impact of these shut downs in the following ways viz.

- Shut down of refineries means lower consumption of Crude. Hence crude stocks should rise. This was what majorly contributed to the drop in crude prices

- The WTI- Brent spread has jumped to its highest level in two years at $ 5.32/bbl.

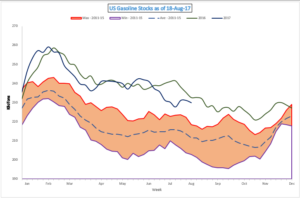

- The shut down of refineries also means lower production of gasoline i.e. Gasoline stocks should tumble and could even be in short supply. Gasoline for immediate supply in the Gulf area have were at five year highs. The first month Gasoline future settled 1.78% higher (even as crude prices dropped) to $ 1.78 / gallon. The gasoline crack has increased by the order of 21% overnight. This is obviously expect to recede in the next few days but is the current status.

Our view is that both movements are exaggerated in a typical market reaction to events of this nature. We expect the market to return to normalcy over the next couple of weeks with crude still moving in a tight $ 48 – $ 52 /bbl range and the gasoline crack receding to levels similar to last week.

As per current reports, approximately 10% of the shut down refining capacity is expected to return to stream in the next 1-3 days.

In the meanwhile, approximately 400 kbd of Libyan crude is shut in due to pipeline blockades.

Naphtha

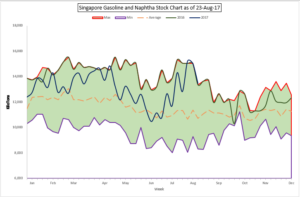

The Naphtha crack is stronger today as a cascading effect of the fallout of Hurricane Harvey. With demand for European gasoline cargoes set to increase, it is expected that supplies of naphtha to the east could reduce. The Naphtha crack is valued at $ 2.65 /bbl

Gasoline

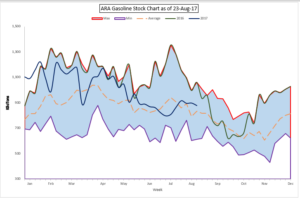

Gasoline cracks are also higher as traders look to source cargoes to ship to the US.

The 92 RON crack for September is valued higher at $ 14.15 /bbl.

We would recommend hedging gasoline cracks at these levels as we expect gasoline prices in the US to recede as the picture becomes clearer in a couple of days. Stocks in both US and Singapore at high levels. Even in the ARA stocks are above the 5 year averages.

At the same time, China is overflowing with Gasoline stocks. Recently there were reports of run rates having slowed down due to excess inventories. Sinopec stated yesterday that it expects to keep its run rates constant despite demand in the second half of 2017 being expected to be lower.

Therefore, all in all, we do not expect there to be a severe shortage of gasoline at any point in time after the immediate few days in the affected areas only.

Distillates

Distillate cracks are at the same level as yesterday. Traders are looking for arbitrage opportunities to move cargoes to the US in the wake of the hurricane.

The September gasoil crack is marginally lower at $ 13.85 /bbl. Regrade has improved to -$ 0.45 /bbl, i.e. the Jet crack remains unchanged.

Fuel Oil

Cash premia for 380 cst cargos continued to rise as Mercuria continued to be an agressive buyer in the window.

The 180 cst crack is marginally lower at -$1.90 / bbl for September. The visco spread continues to stay at $ 0.65 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity