Crude Oil

Benchmark Crude prices moved and settled in opposite directions yesterday in the wake of mixed U.S. Inventory data released by the DOE yesterday. Brent closed down 54 cents to settle at $57.90 /bbl while WTI ended 26 cents higher to settle at $52.14 /bbl.

With the Brent-WTI spread touching their highest levels in more than two years, U.S. crude has become increasingly competitive in foreign markets as evidenced by their export numbers which hit a record of 1.5 million bbl/day last week.

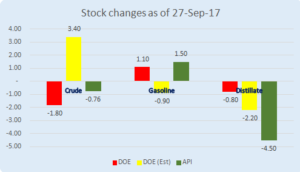

DOE Report

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.8 million bbls from the previous week as against an estimated build of 3.4 million bbls. At 471 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year. On the products side, total motor gasoline inventories posted a surprise build of 1.1 million bbls last week as opposed to an expected drawdown of 0.9 million bbls. Distillate fuel inventories saw a decrease of 0.8 million bbls last week significantly lower than the expected decline of 2.2 million bbls.

Refineries operated at 88.6% of their operable capacity last week, up from 83.2% in the week earlier. The Domestic production of crude last week was also up by approximately 37,000 bbls/day at 9.54 million bbls/day as compared to the previous week.

Total products supplied over the last four-week period averaged 20.3 million bbls/day, up by 1.3% from the same period last year. Over the last four weeks, motor gasoline product supplied averaged over 9.4 million bbls/day, up by 0.6% from the same period last year. Distillate fuel product supplied averaged over 4.0 million bbls/day over the last four weeks, up by 13.9% from the same period last year.

Naphtha

The naphtha cracks continued to slide amidst a quiet physical market attributed to the ongoing APPEC conference in Singapore.

The October crack is valued lower at $ 2.50 /bbl

Gasoline

The gasoline cracks have also fallen on the back of a surprise build in U.S. Gasoline inventories as declared in its weekly Report by the DOE yesterday.

The October 92 Ron crack is valued lower today at $ 10.85 /bbl.

Distillates

The distillate cracks have managed to strengthen as some fresh spot demand in the market is keeping traders interested. In the Platts Trading Window, three Singapore gasoil cash deals were reported.

The October crack is higher at $14.05 /bbl. The regrade too is higher at$ 0.60 /bbl

Fuel Oil

Fuel Oil cracks have also posted a small gain on the back of expectations of narrow arbitrage arrivals into Singapore, stock draws and firming demand.

The October crack is valued at -$3.00 / bbl. The visco spread is at $ 0.65 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity