Crude Oil

Crude prices completed a week of daily gains amidst steady determined buying. Brent gained 49 cents to settle at $ 48.91 / bbl. while WTI gained 46 cents to settle at $ 46.54 / bbl.

The rise in prices, along with bullish DOE data, is being ascribed to reports from the IEA suggesting an increase in demand. The increase in Chinese imports was also a factor of much cheer to the bulls.

We are of the opinion that these factors would act more to put a bottom in place for oil prices rather than spurring growth to new highs.

On the supply side, as oil prices rise, shale producers get the opportunity to hedge even further out making their operations even more sustainable. We are yet to see the impact of US production rise to the anticipated level of close to 10 mbpd. Baker Hughes also reported an addition of 2 oil rigs in the US, bringing the rig count up to 765 which would suggest that even 10 mbpd is not really the cap. Among non US suppliers, we are seeing compliance with the production quotas slipping a bit with no indication to suggest that they will be adhered to in future.

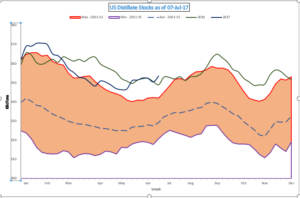

On the demand side, the demand growth in the US has been mild for gasoline, if at all. And we are still in driving season. What is likely to happen once this demand tapers off is anybody’s guess. While distillate demand has been strong over the past few months, distillate stocks are at their highest for this time of the year. Unless we get something like an extremely severe winter, we are unlikely to see a depletion in these stocks.

Technical Analysis

Technically, the daily chart suggests that we may be in a Wave (c) of IV if we take the fall from $56.65 to $ 46.64 as wave I. The subsequent fall from $ 54.67 to $ 44.35 would be the Wave III (barely, but just about qualifies as Wave III). This would suggest that another strong fall is in the offing from some level in the near future. For the immediate though, oscillators are still showing bullish leanings. Having said so, we are approaching the 50 DMA as a resistance point.

The weekly charts show a an interesting rising channel within a falling channel with the boundaries of neither channel being tested seriously currently. The MACD appears to be rising fast towards a cross over and a strong week should see this happen.

Supports currently lie at $ 46.51, the most recent low, $ 44.35 the low from a month ago and then arguably at the $ 41.50 level.

Resistances are at the 50 DMA level of $ 49.1 /bbl which is whereabouts we are at currently, then the psychological $ 50.00 /bbl and then $ 51.00/bbl levels.

Naphtha

Naphtha market continues to be under pressure as buyers take advantage of the supply glut by procuring cargoes at lower prices. South Korea’s LG Chem was heard to have bought naphtha for second-half August delivery at discounts of around $3.25 /MT to Japan quotes on a cost-and-freight (C&F) basis, better than the discount of $3.00 /MT it paid only a few days ago for a cargo for the same delivery period. There was also news of Taiwan’s Formosa Petrochemical Corp having bought 60,000 tonnes of naphtha for second-half August at a discount of about $5.00 /MT to to its pricing formula, the lowest price paid by Formosa since December 2016.

Both the July crack at -$0.80 /bbl and the August crack at -$0.60 /bbl are unchanged from Friday.

Gasoline

Asia’s Gasoline crack have managed to strengthen slightly even as stock levels rose in the Singapore hub but fell in Europe and the United States.

The July crack has improved to $ 11.00 /bbl while August has risen to $ 10.45 /bbl.

Distillates

Distillate cracks have also managed to strengthen notwithstanding the inventory builds in both Amsterdam-Rotterdam-Antwerp (ARA) and Singapore. Jet fuel stocks in ARA are up 14 % from the previous week to a six-week high of 0.73 million tonnes while ARA gasoil inventories are up 1 % from the previous week to a two-week high of 2.92 million tonnes. Interestingly, when compared with the same time last year, ARA jet fuel stocks are 12 percent higher in contrast to gasoil inventories which were 13 percent lower.

The July gasoil crack is higher at $ 13.05 /bbl and August is up at $ 12.35 /bbl.

The July regrade is valued at -$1.05 /bbl for July. August is unchanged at -$0.50 / bbl.

Fuel Oil

Fuel oil cracks have fallen marginally as Singapore onshore fuel oil inventories rose 2 percent, or 67,000 tonnes, to a total of 3.27 million tonnes in the week to July 12 despite a 28 percent drop in net imports. In contrast however, Fuel oil stocks in the ARA hub fell 14 percent to a three-week low of 825,000 tonnes in the week to July 13. ARA fuel oil inventories are now down 12 percent from the same time last year.

The 180 cst July crack is marginally lower at -$0.40 / bbl while the August crack is at -$0.70 /bbl.

The July visco spread is unchanged at $0.90 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.