Crude Oil

Oil prices ended largely unchanged on Tuesday as a weaker dollar spurred a rebound from an early slide after the IEA forecast that supply could outstrip demand. Brent crude futures settled 13 cents higher at $ 62.59 /bbl. WTI, however, gave up 10 cents to close at $59.19 /bbl.

The IEA in a shortened monthly Oil Market report commented “Today, having cut costs dramatically, US producers are enjoying a second wave of growth so extraordinary that in 2018 their increase in liquids production could equal global demand growth.” This could pose problems for the cartel with Iran, as well as Russia, straining at the leash.

As mentioned in an article on Bloomberg. “A massive week-on-week jump of 332,000 barrels a day must be treated with caution, though. U.S. drillers didn’t have a sudden rush of enthusiasm as WTI prices broke through a psychological $65 ceiling. Rather, the weekly data, which aren’t revised retrospectively, are catching up with monthly estimates that give a more accurate picture of output.”

Saudi Arabia appears to be caught between a rock and a hard place as falling prices could affect its IPO, thereby preventing it from applying its previous strategy of flooding the market.

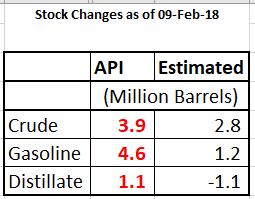

API Data

The API data too failed to provide an cheer to bullish traders with both crude as well as products reporting significant draws. Given that the market expected a draw in distillates, the report is quite bearish.

The API data too failed to provide an cheer to bullish traders with both crude as well as products reporting significant draws. Given that the market expected a draw in distillates, the report is quite bearish.

If this report is confirmed by the DOE, the market will need a very weak dollar to sustain at these levels or climb.

Naphtha

The physical Asian naphtha crack recovered marginally to settle at $ 67.05 /MT yesterday.

Naphtha arriving in Asia this month from the West including Europe and the Meditararean are estimated at 1.5 to 1.6 million tonnes. For two straight months this year, the monthly volumes have been higher than 2017’s monthly average at about 1.2 million tonnes. Cargoes arriving this month from the Middle East were seen at 2.6 to 2.7 million tonnes, up slightly from January’s volume at about 2.4 to 2.5 million tonne.

The balance February paper naphtha crack is higher at $ 0.35 /bbl as is the March crack at $ 0.40 /bbl

Gasoline

Asia’s gasoline crack fell to a 2-1/2 week low of $7.69 a barrel as deals came to a standstill in the Singapore cash market following a recent buying spree by Singapore trader Hin Leong.

The balance February paper 92 Ron gasoline crack has sunk to $ 10.50 /bbl with March also down at $ 10.95 /bbl

Distillates

Asia’s jet fuel cash premium to Singapore benchmark prices extended gains to $1.10 a barrel on Tuesday, the highest in more than five years. Demand for air travel and the need for kerosene for heating in Japan have supported the market. After the cold season passes, refineries in North Asia will begin maintenance and this will impact supplies.

The balance February paper gasoil crack has also plummeted to $ 13.35 /bbl. The 10 ppm crack is at $ 14.05 /bbl. The February regrade has also dropped to $ 0.95 /bbl today.

The March paper gasoil crack is valued at $ 13.45 /bbl. The 10 ppm crack is at $ 14.15 /bbl. The March regrade is valued higher at $ 0.45 /bbl today.

Fuel Oil

Asia’s front-month high-sulphur fuel oil crack narrowed its discount to Brent crude on Tuesday for a third straight session, boosted by falling crude oil prices since the start of February. At close of market yesterday, the March crack to Brent was quoting at nearly 85 cents higher than on Monday.

The February 180 cst crack is valued marginally higher at -$ 3.20 /bbl. The visco spread is unchanged at $ 0.85 / bbl.

The March 180 cst crack is also valued much higher at -$ 3.00 /bbl. The visco spread stays at $ 0.95 / bbl. We would recommend hedging the crack at current levels and adding more if it strengthens further.

We would also recommend hedging 2Q2018, 3Q2018, 4Q2018 and 1Q 2019 cracks at current values of -$ 2.80 / bbl, -$ 2.40 /bbl, -$ 2.05 /bbl and -$ 2.35/bbl

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity