Crude Oil

Crude Oil prices surged more than 2 % on Monday amid easing apprehensions of a trade war between the United States and China. Brent closed $1.54 /bbl higher at $68.65 /bbl while WTI settled $1.36 /bbl higher at $63.42 /bbl.

In intraday trading, Brent prices gained 2.3 %, its largest daily percentage gain since March 21. Similarly, WTI witnessed a 2.2 % gain, its largest daily percentage rise since March 23 earlier this year.

Save for the recent developments of the aforementioned trade war, oil prices have been supported so far this year by healthy demand and supply restraint spearheaded by the Organization of the Petroleum Exporting Countries (OPEC).

Naphtha

The physical Asian naphtha crack settled higher yesterday at $84.38 /MT with the markets continuing to show presence of strong demand for physical product.

The balance April crack for Naphtha though continues to fall and is valued at – $ 0.75 /bbl. today. The May crack is valued at -$ 1.00 /bbl

Gasoline

The weakness in the Asian gasoline market continued as the gasoline crack fell to its lowest in about a week and a half at $7.89 /bbl on Monday. Excess European supplies with traders estimating as much as 400,000 MT stored in ships off Europe’s coast are keeping prices in check across markets. The Asian Platts Trading Window was very active yesterday with five cash deals getting concluded.

The balance April crack has has dropped to $ 10.65 /bbl . The May crack is at $ 11.25 /bbl

Distillates

Distillate market remains tight due of firm demand on the back of seasonal refinery turnarounds. The upcoming summer demand will likely keep prices supported over the next couple of months even as refineries start returning from maintenance.

Cash differentials for 10 ppm gasoil climbed on Monday to $ 0.40 /bbl to Singapore quotes, up from $ 0.38 /bbl on Friday. On the other hand, cash differentials for jet fuel dipped to $1 /bbl to Singapore quotes on Monday.

The April gasoil crack is at $ 15.15 /bbl with the 10 ppm crack at $ 15.90 /bbl. The regrade is unchanged at $ 0.95 /bbl.

The May gasoil crack is at $ 15.05 /bbl with the 10 ppm crack at $ 15.75 /bbl. The regrade is unchanged at $ 0.40 /bbl.

Fuel Oil

The Asian 180-cst fuel oil market snapped six consecutive days of gains on Monday, retreating from a near 10-month high, amid lower deal values for cargoes of the lower viscosity fuel oil in the Singapore trading window. Over the past few weeks, the market for lower viscosity fuel oil had been boosted by concerns of tight blendstock supplies as well as ample inventories of high-viscosity fuel oil.

In contrast, firm buying interest for 380-cst lifted cash premiums of the higher viscosity fuel to its highest since March 14 last month.

The April 180 cst crack has fallen to -$ 4.80/ bbl. The visco spread is at $ 2.10 /bbl

The May 180 cst crack is at -$ 4.85/ bbl. with the visco spread unchanged at $ 1.90 /bbl

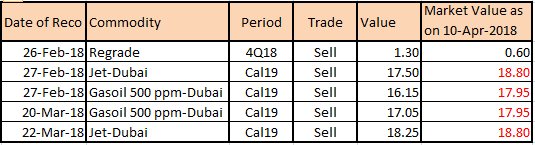

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.