Crude Oil

Crude Oil prices settled at their lowest level in two weeks as investors moved away from riskier assets amid fears that a trade war between the world’s two largest economies could deal a blow to global growth. Brent futures settled $ 1.22 lower at at $67.11 /bbl. WTI futures lost $ 1.48 to settle at $62.06/bbl.

For the week, WTI lost about 4.4%, its biggest such decline since the week ended Feb. 9, while Brent saw a weekly fall of 4.5%, its biggest since the week ended March 2.

Adding to the bearish sentiment was the news that US drillers pressed 11 more rigs into service bringing the total count to 808.

In the hysical oil markets, OPEC’s number two producer, Iraq, said on Monday that it is keeping prices for its crude supplies in May steady.

![]()

09 April 2018

The Evening Star…………

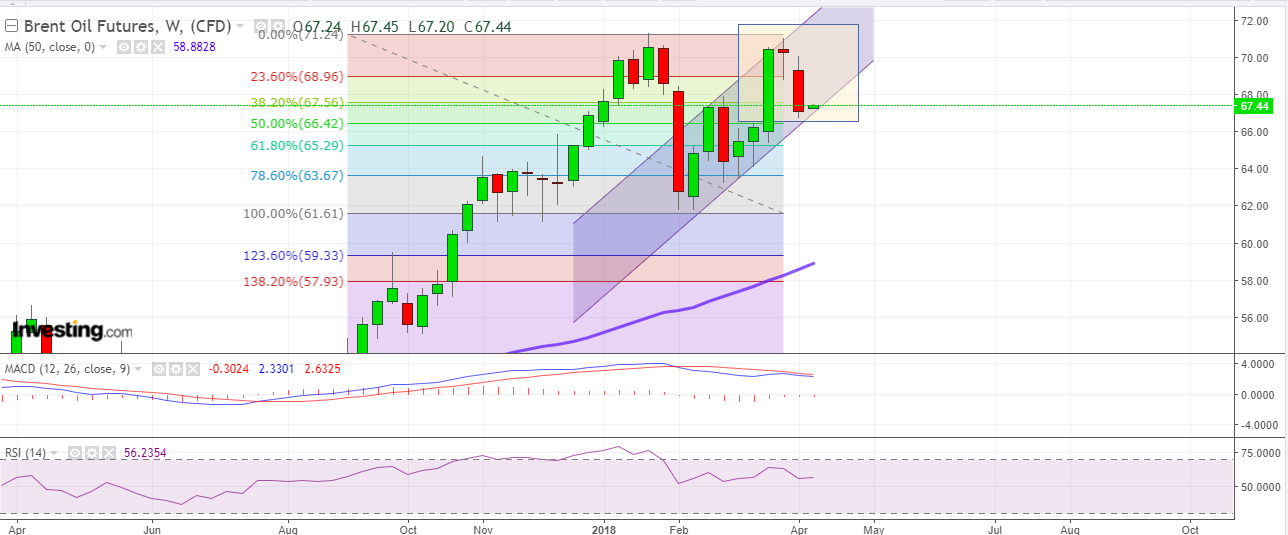

appears before the long night. In our weekly chart we see a pattern known as ‘Evening Star’ (highlighted in Orange). This pattern typically marks the end of a preceding uptrend.

This gains more significance given that it is in the same area of the previous swing high (70.50-71.50) seen in January 18.

So does this mean that we are changing our larger bullish stance basis the monthly charts? No, not quite. The call last week was to expect follow through selling into the 67.25-67.50 area, offering this as a target for astute short-term traders going short. These targets have been met.

Trading Strategy

The larger call was to use the dip to 67.00-67.50 to accumulate.

The charts still support this call. However, given the evening star pattern on the Weekly charts, we would recommend going slow and taking your time to build long positions.

Supports and Resistances

Resistances are at the $ 67.75 area and then $ 69.00 and $ 71.28 /bbl. .

There are many broad supports are in the $ 65.50 – $67.50 area. Key among them would be the 50 DMA at $ 66.60 and the 100 DMA $ 67.15-20 range. Further support lies below around $ 65.45-55 area.

Naphtha

The front month time spread (2H May – 2H June) increaased to $ 13.75 / MT yesterday, underscoring the tightness in the physical markets. This is a reflection of the strong demand for physical product. Cash premiums are ranging between $ 13.50-15.00 / MT to CIF Japan quotes.

The balance April crack for Naphtha though has continued to fall and is valued at – $ 0.65 /bbl. today. The May crack is valued at -$ 0.95 /bbl

Gasoline

Asia’s gasoline crack was dipped to $ 8.04 /bbl. on Friday. The sentiment for Gasoline continues to be weak and would be supported (if that is the correct word to use), by the upcoming driving season.

The balance April crack has has dropped to $ 10.75 /bbl . The May crack is at $ 11.35 /bbl

Distillates

Asia’s cash differentials for gasoil with 10ppm sulphur content firmed on Friday as the market remained optimistic about stronger short-term demand, while inventories for the industrial fuel in the Amsterdam-Rotterdam-Antwerp (ARA) storage hub declined. The cash differential for gasoil with 10ppm sulphur content edged higher to 38 cents a barrel to Singapore quotes, compared with 36 cents on Thursday. The middle distillates market will remain well-supported at least over the next two to three months as refineries go into turnaround.

Cash differentials for jet fuel dipped to $1.11 a barrel to Singapore quotes on Friday, compared with $1.15 on Thursday.

The April gasoil crack is at $ 14.90 /bbl with the 10 ppm crack at $ 15.60 /bbl. The regrade has improved to $ 0.95 /bbl.

The May gasoil crack is at $ 14.80 /bbl with the 10 ppm crack at $ 15.50 /bbl. The regrade is at $ 0.40 /bbl.

Fuel Oil

Asia’s 380-cst fuel oil cash differential flipped to a premium on Friday following strong buying interest for cargoes of the fuel for a second straight session. The 380-cst fuel oil cash premiums were at 27 cents a tonne to Singapore quotes on Friday, up from minus 39 cents a tonne in the previous session and minus 82 cents a tonne on Monday. Trade sources pointed to falling Singapore fuel oil inventories as well as renewed buying interest from Pakistan’s state-oil company this week as bullish factors, but some were still puzzled by the abrupt shift in sentiment this week.

The 380-cst fuel oil market had recently been weighed down by ample supplies of high-viscosity fuel oil in the Singapore area. On Tuesday, when 380-cst fuel oil cargoes first traded in the Singapore window this week, Hin Leong had lifted one cargo of the fuel at the equivalent of about $1.25 a tonne below Singapore quotes. Hin Leong on Friday was the sole buyer of all three 380-cst cargoes traded in the window, paying differentials between around minus 11 cents per tonne to plus $1 tonne to Singapore quotes for the different cargoes.

The April 180 cst crack has strengthened to -$ 4.25/ bbl. However, the visco spread has blown out to $ 2.00 /bbl

The May 180 cst crack is at -$ 4.30/ bbl. with the visco spread at $ 1.90 /bbl

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.