Crude Oil

Oil prices were ‘talked up’ from the sidelines of the CERAWeek Energy conference by OPEC. Brent futures gained $ 1.17 to settle at $ 65.54 /bbl. WTI rose $ 1.32 to settle at $ 62.57 /bbl.

During the day, at the CERAWeek conference, various dignitaries from the OPEC pointed out (fairly valid) issues like

- Venezuela’s output was running 1.5 mb/d short of its historical peak and there were issues about production levels returning there which the ‘country must address itself’

- OPEC felt that there still existed a supply overhang

The market also took heart from a strong recovery of the US stock markets with the S&P index being up over 1% shortly before close of trading.

Hedge funds and other money managers boosted their net length in crude futures and options contracts by 39,000 contracts last week. The increase was almost evenly split between Brent (21,000) and WTI (18,000)

In the meanwhile, Libya’s Sharara oil field resumed production on Monday. The closure was attributed to the illegal closure of a pipeline valve.

In other news, the IEA released its “Oil 2018” Report yesterday. Major points include

- US total liquid Hydrocarbon production will rise to 17 mb/d by 2023. This could be higher if prices stay above $ 60 /bbl. This will allow the US to cover over half the expected global demand growth to then.

- Global demand growth is expected to slow, but not peak by 2023 increasing by 1.1% p.a. on average

- Demand growth will shift to petrochemicals and away from motor fuels due to increasing fuel efficiency and declining consumption

- Asian Oil Supply is expected to fall steeply with China leading the decline

Naphtha

Asia’s naphtha crack continued to recover settling at $ 85.53 /MT yesterday due to continued demand from consumers like Korea’s SK Energy and Japan’s JXTG.

The March crack has however dropped to $ 0.95 /bbl

Gasoline

In contrast to Naphtha, Asia’s gasoline crack to continued its downward move, settling at $8.37/bbl yesterday. This mirrored March 2’s trend in Europe, where the northwest European gasoline crack halved during the week to Friday to $3.5 per barrel, the lowest since late 2014, according to Jefferies, a leading consulting firm in Europe.

The March 92 Ron gasoline crack has dropped to $ 11.85 /bbl

Distillates

Asia’s jet fuel cash premiums fell to a seven-session low on Monday, weighed down by lower supplier offers and expectations of a market correction as the strong seasonal demand fades and supplies are replenished. In a potential sign of slowing spot demand for jet fuel, no cargo trades were reported in the Singapore window despite lower supplier offers.

Cash differentials of the benchmark 10ppm gasoil also started the week lower, flipping into a discount after lower supplier offers led to elevated trade volumes in the Singapore trading window.

The March paper gasoil crack has tumbled to $ 13.65 /bbl. The 10 ppm crack is at $ 14.20 /bbl. The March regrade though, is steady, indeed marginally higher at $ 2.55 /bbl today.

Fuel Oil

The front-month East-West (EW) arbitrage spread of 380-cst fuel oil narrowed on Monday as suppliers locked in more volumes from the European oil hub for delivery into Singapore over April-May. The April EW spread was trading at about $13 a tonne on Monday, 25 cents a tonne lower from the previous session. Three very large crude carries (VLCCs) have been chartered over the past week to ship fuel oil from the Rotterdam oil hub in March for discharge into Singapore.

The March 180 cst crack has weakened to -$ 4.45 /bbl. The visco spread has eased to $ 1.15 / bbl.

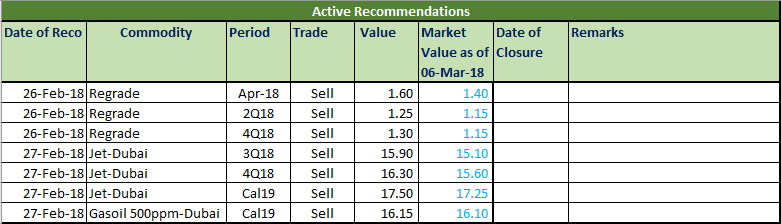

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.