Crude Oil

Crude retreated further from the highs of the beginning of the week. Brent closed down 49 cents to settle at $57.41 /bbl while WTI ended 58 cents lower to settle at $51.56 /bbl.

The retreat is not surprising bearing in mind

- The DOE report which seemed to suggest that things are returning to normal and there may not be a shortage of either crude or products

- The large length in futures and options contracts held at the end of last week which need some easing out.

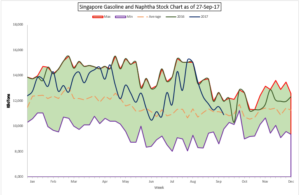

Naphtha

The naphtha cracks continued to slide amidst a quiet physical market attributed to the ongoing APPEC conference in Singapore. It is expected to resume stronger in the next few days.

The October crack is valued lower at $ 2.40 /bbl

Gasoline

The gasoline cracks strengthened on the back of a drop in Gasoline stocks in Singapore yesterday to nearly a 3 month low of just under 11 million barrels. Gasoline stocks have now dipped under their 5 year average for this time of the year.

The October 92 Ron crack is valued lower today at $ 11.45 /bbl.

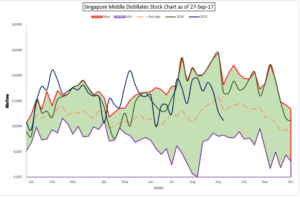

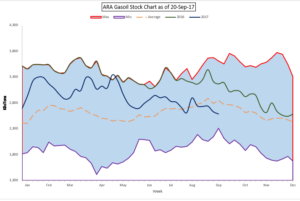

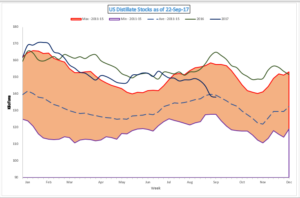

Distillates

The distillate cracks have further improved in strength even as stocks decreased in Singapore to a 3 month low of 10.48 million barrels. Distillate stocks are below their 5 year average in Asia, Europe as well as the USA and a cold winter in the US and Europe could make the distillate crack very interesting.

The October crack is higher at $14.35 /bbl. The regrade has retreated to $ 0.40 /bbl

Fuel Oil

Fuel Oil cracks have strengthened following a strong draw of 1.3 Million barrels to 23.3 million barrels. However, this may not be long lived as the ARA reported a build of 1.2 Million barrels

The October crack is valued at -$2.55 / bbl. The visco spread is at $ 0.60 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity