Crude Oil

Oil prices rose on Friday as the market is seeking to find new levels for oil prices in the wake of all the uncertainty of the last week. Brent futures gained 49 cents to settle at $73.07 / bbl. WTI settled $ 1.00 /bbl higher at $70.43 /bbl. However, this could be ascribed to the expiring future which could be beset with delivery issues. The more active September future gained just 2 cents to settle at $ 68.26 /bbl

Brent prices were supported by a weaker US Dollar and expectations that Saudi exports in August would lower than June.

For the week though, Brent lost 3%. WTI, bolstered by supply shortages, lost just 0.8%

The number of active rigs in the US fell by 5 to 858 last week as per the Baker Hughes weekly report.

In other news, production at Libya’s Waha field is said to have increase to 130 kb/d and should rise next week to around 300 kb/d. This comes after the Es Sider port was re-opened on July 11.

![]()

23 July 18

Take a step back………..and keep wathing

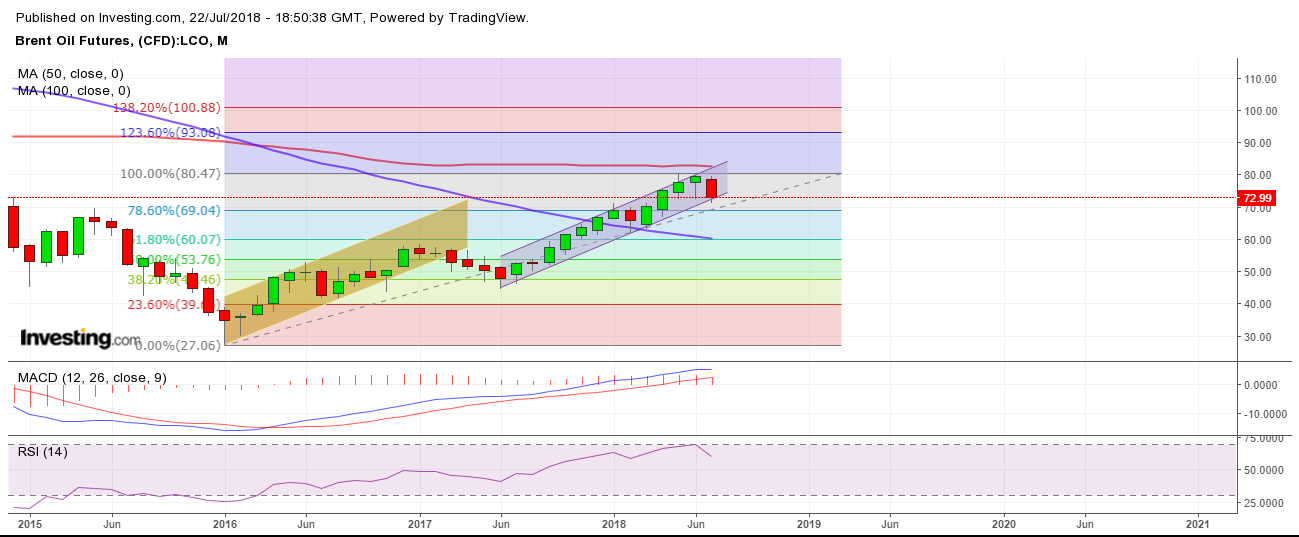

Last week’s was a relatively shorter candle with a height of around $ 4.2 /bbl. Most of the drop of the week took place on the first day. While the market has been attempting to recover for the rest of the week, the 100 DMA, which we had pegged as a support level last week, has now held as a key resistance level once it was pierced on Monday. One the lower side, the market tested but was not successful in breaking the low reached on Monday as any attempts to move below that were countered by strong buying. The $ 71.20-50 range will be a key support for this week.

In the longer term charts, it is worth noting that last week’s candle was completely below the long term rising channel that prices had been moving for the last six months which lends strength to the belief that we may have seen the end of wave III which we had suggested last week. Oscillators in the longer term charts are still hovering in the bullish range indicating that the down move could still have some way to go. We will continue to hold $ 69.00 as our target while prices trade below $ 74.50.

Trading Strategy

The daring long position we had suggested was stopped out on the first day of trading itself. The market still seems uncertain which would make us want to continue to stay on the sidelines unless the market conclusively breaks either $ 71 (following which we believe that $ 69 is the next target) or the 100 DMA which is currently at $ 73.50 levels. If the break out is to the upside, we would recommend buying above $ 73.50 with a target of first $ 76.00 and then $ 78.00. Those with a bearish bias, can consider selling around here and adding below $ 71 with a target of $ 69.00 /bbl.

Supports and Resistances

The current level of $73 /bbl has been pretty much a pivotal area with prices refusing to move strongly away from this level. If the is breached, we then have the next level at around $ 72.35 below which there is strong support in the $ 71.20-40 range.

Resistances would appear to be first at the 100 DMA around $ 73.50, then around $ 74.5 – 50 range and then in the $75.80 – 76.00 area.

Naphtha

Asia’s naphtha crack was near a two-month high of $100.18 a tonne on Friday, supported by strong demand for the feedstock from petrochemical makers.

The August crack, has improved to -$ 0.20 /bbl

Gasoline

Asia’s gasoline crack hit a five-week high of $6.29 a barrel but the value still paled versus $10.95 in 2017 but sharply higher than 2016 at $1.83 for the same period. South Korean S-Oil was looking to buy gasoline in a rare move to plug a supply gap as a new unit has not yet reached optimum throughput.

The August crack is higher at $ 9.05 / bbl

Click Here for a graphical depiction of Global Gasoline stocks by region.

Distillates

Asia’s cash discounts for gasoil with 10ppm sulphur content were at 18 cents a barrel to Singapore quotes, as against a discount of 25 cents on Thursday. Diesel is in oversupply in the region partly because refiners in China are exporting a lot but Chinese jet exports, as compared to gasoil, are not so huge in volumes.

Meanwhile, cash differential for jet fuel flipped into a premium on Friday as the front-month spread narrowed its contango structure. Cash premiums for jet fuel were at 5 cents a barrel to Singapore quotes, compared with a discount of 1 cent on Thursday. Strong aviation demand aided by summer travelling interest is supporting the jet markets.

The August crack is higher at $ 14.00 / bbl with the 10 ppm crack at $ 14.90 /bbl. The regrade is lower at $ 1.10 /bbl

Click Here for a graphical depiction of Global Distillate stocks by region.

Fuel Oil

Asia’s 380-cst high-sulphur fuel oil extended gains on Friday, with cash premiums, time spreads and cracks climbing to fresh multi-year highs, amid a persistent shortage of finished grade fuel oil in the Singapore trading hub.

The 380-cst time spread for August/September climbed as high as $9.25 a tonne earlier on Friday before easing to about $8.80 a tonne by the end of Asian trading hours. The front-month time spread was last higher in June 2015. Strong buying interest also pushed 380-cst cash premiums to $7.68 per tonne to Singapore quotes on Friday, their highest in a little over three years.

Similarly, the August 380-cst barge crack discount to Brent crude was as narrow as $7.75 a barrel on Friday before retreating to minus $8.10 a barrel. On Thursday, the front-month barge crack settled at minus $8.28 a barrel.

Strong seasonal demand for fuel oil particularly from power producers in the Middle East, along with falling inventories across key storage hubs, have tightened arbitrage flows of the fuel into Singapore over the past three months. Adding to the shortage of resupply into Singapore, this week at least two fuel oil shipments were facing delays.

China is reportedly shifting to 0.5% sulphur in Fuel Oil from January 19 itself, one year ahead of the Marpol deadline.

The August 180 cst crack has jumped to -$ 0.45 / bbl with the visco spread at $ 1.40 /bbl

Click Here for a graphical depiction of Fuel Oil stocks by region.

Hedge Recommendations

The August and September Fuel Oil cracks continue to strengthen. For refiners who still to reach their maximum levels of hedging, we will recommend adding 1 more tranche of August Fuel Oil. The rationale for this hedge is largely one of discipline. We rarely see these levels in forward positions and, as far as settles go, cracks have settled at such levels only 4 times in the last 5 years.

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Click Here to see how all our recommendations have fared

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.