Crude Oil

Oil hit a six-week high on Wednesday, closing in on a 3-year peak set in late January, on a surprise decline in U.S. inventories, strong compliance on OPEC production cuts, and persistent concern related to the Iran nuclear deal. Brent crude rose $ 2.05 to $69.47 / bbl. WTI futures rose $ 1.63 to settle at $ 65.17 /bbl, their highest price since Feb 2.

Crude prices were also lifted by a slump in the USD index which values the dollar against a basket of currencies. This slump has apparently come due to a interest rate hike in the US. This drop is counterintuitive as a rate hike usually works towards strengthening a currency.

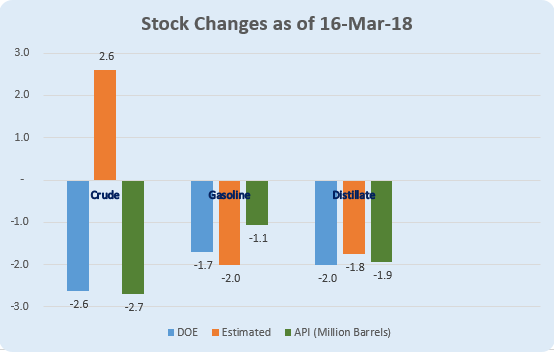

The data published by the DOE showed a surprise drop in crude stocks by 2.6 million barrels to 428.31 million. Given expectations of a build, this single statistic spooked the markets into climbing over $2/bbl in Brent prices

The draw in Gasoline was less than expected while that in distillates was more or less in line with expectations. Both, the API as well as the DOE returned fairly similar figures this week.

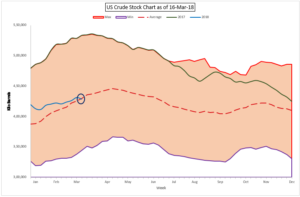

This latest draw in crude stocks has pulled them below the five year average (2013-17).

This latest draw in crude stocks has pulled them below the five year average (2013-17).

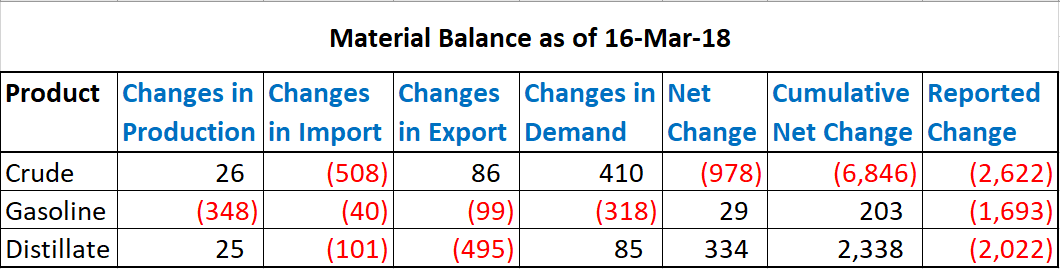

The drop in crude stocks is attributable to a drop in crude imports by 500 kbp/d as well as an increase in run rates by another 400 kb/d. However, an analysis of the material balance shows an imbalance between crude used and products produced for the second week in a row.

The material balance analysis also suggests that both gasoline as well as distillate stocks should have built rather than drawn. Gasoline demand dropped significantly by 318 kb/d to a more regular level of around 9.3 mb/d.

Naphtha

Asia’s naphtha open-specification front-month price for first-half May was $8.50 a tonne higher than that for first-half June, making this the widest inter-month spread since Jan. 11, due to tighter supplies. Fewer cargoes arriving in Asia this month from the West including Europe, was a key reason behind the tighter supplies. Although more cargoes could be arriving in Asia in April from the West versus March at some 1 million tonnes, the increase in volumes may not be significant

The April crack has dropped further to – $ 0.30 /bbl flat.

Gasoline

Asia’s gasoline crack recovered marginally to settle at $ 7.55/bbl yesterday. This brings the average for March 1-21 to about $8 a barrel versus $8.70 for the same period last year. Recent outages in Taiwan’s CPC refineries failed to affect the market due to ample supplies, especially in Europe where traders were storing gasoline onboard vessels.

Iranian gasoline imports have dropped sharply in recent weeks due to starting up the second phase of the Persian Gulf Star Refinery, according to a Reuters report. The report estimates that imports of gasoline will drop to around 70 KT in March, compared to 120 KT in the last two months and 300 KT in December 2017.

The Fujairah Oil Industry Zone reported an increase of 963 kb to 7.66 million barrels yesterday. Stocks are 35% higher than last year’s levels.

The April crack is slightly higher at $ 11.60 /bbl

Distillates

Asia’s jet fuel price premiums rose on Wednesday and the front-month time spread widened its backwardated structure, while middle distillate inventories in the Fujairah Oil Industry Zone (FOIZ) climbed 34 percent to the highest in nearly two months.

Jet fuel cash premiums rose to 32 cents a barrel to Singapore quotes, compared with 21 cents on Tuesday. Market participants expect the aviation fuel market to stay well supported at least until May, on the back of heavy refinery maintenance across Asia.

The cash differential of Asia’s 10ppm gasoil were at 26 cents a barrel to Singapore quotes, down slightly from 28 cents on Tuesday.

Middle distillates inventories in the Fujairah Oil Industry Zone (FOIZ) climbed 34 percent from a week ago to 2.6 million barrels in the week ended March 19. The 653 KB build in Fujairah middle distillate inventories over the past week is almost equivalent to the draw down of 652 KB barrels in the week earlier. It is also the largest weekly inventory build in nearly two months. Compared to year-ago levels, Fujairah middle distillate inventories are 43 % lower.

The April gasoil crack has firmed up to $ 14.80 /bbl with the 10 ppm crack at $ 15.55 /bbl. The regrade is steady at $ 0.30 /bbl.

Fuel Oil

Asia’s front-month high-sulphur fuel oil crack widened its discount to Brent crude on Wednesday, slipping to a near two-month low amid rising crude prices and firm supplies of the fuel in key storage hubs. The April 180-cst fuel oil crack to Brent settled at minus $8.69 a barrel on Wednesday, its widest discount since Jan. 24. This came amid rising oil prices on Wednesday which were lifted by tensions in the Middle East and healthy demand.

Fujairah Oil Industry Zone (FOIZ) fuel oil inventories inched up to a nine-week high of 7.389 million barrels in the week to March 19. The incremental 34 KB increase in Fujairah fuel oil stocks marks the third consecutive week of inventory builds in the Middle East storage hub. Compared with year-ago levels, however, Fujairah fuel oil inventories are 32 percent lower.

The April 180 cst crack has dropped further to -$ 5.95 / bbl with the visco spread widening to $ 1.25 /bbl

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

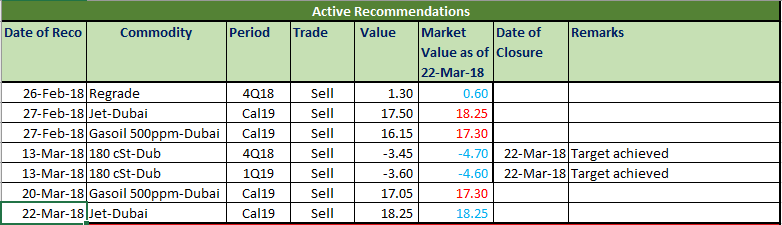

The falling down of the Fuel Oil cracks has resulted in our meeting our target for the whole strip.

Gasoil continues to be strong, taking jet along with it. This often brings us to the question: “Should we hedge more at these levels when the market is headed higher?”. There is no right answer to the question. However, a hedging program should essentially not be calling the market. Today, we are recommending adding to our Jet hedge for Cal-19 at $ 18.25 /bbl. This level has only been reached 10% of the times in the last five years. i.e. this is truly an exceptional level and one would recommend locking a little margin at such levels.

Today’s status of active recommendations is below.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.