Crude Oil

Continued weakness in the US Dollar and strength in US stocks helped Crude Oil futures rise for the third day in a row. Brent crude futures settled at $ 64.51 /bbl, gaining 51 cents. WTI, gained 34 cents to close at $61.68 /bbl.

While crude futures have retraced close to 50% of the fall from the close of two weeks ago to the low of last week, there has been a noticeable reduction in the bullishness in the market. Money managers slashed their bullish wagers on Brent futures by 32,054 contracts, the most in nearly eight months and WTI by 22,141 contracts, the most since late August, as CFTC data for in the week to Feb. 13 showed.

The bullishness of the last two months also appears to have shown up in increased rigs with a lag. Baker Hughes Energy services reported a further rise of 7 units in its rig count last week. At 798, this is the highest level of operating rigs in the US in the last 3 years. Its implication for increase in production cannot be ignored.

A little-noticed addition to the U.S. budget deal approved last week was also expected to further boost U.S. crude production by more than tripling a tax credit to producers for injecting carbon dioxide back into the earth to increase output.

The market is expected to be muted today with the US closed for President’s day holiday and the UK likely to be busy this week in the IPE Week meetings.

Technical Analysis

A Week Spent Retracing a Day

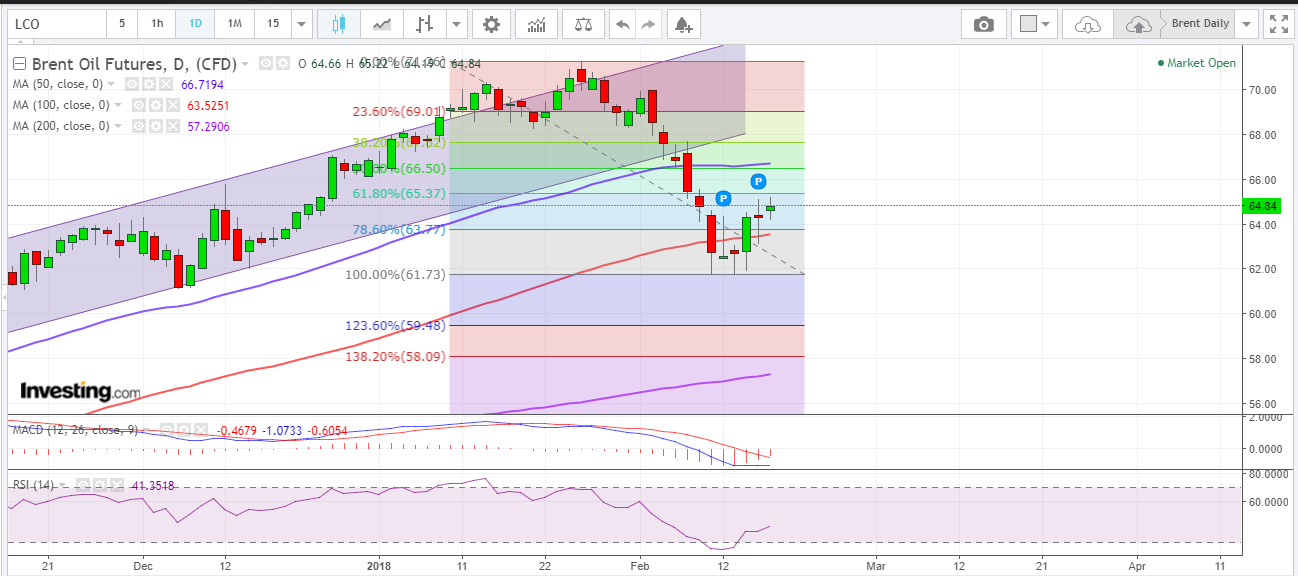

Last week, we had called for a turn down in the tradeable trend to sell on a pull back to the 64-65 levels as long as the current capitulation lows of 61.77 hold.

The week under review sees this pull back. As pullbacks go, this is a fairly feeble one as the markets spent all week retracing just one day’s action i.e. last Friday’s break down.

Two subtle technical pointers are worth mentioning.

- The previous Friday’s capitulation low was tested last week and held. So till such time this $ 61.77 low holds, we are unlikely to see fresh ‘break downs’.

- The last two days of the week saw high’s of $ 65 levels being sold into. This is consistent with the exhaustion of the pullback.

Trading strategy

While the trade for the week would be to sell at current levels with a stop above $ 65.30, it is not a high conviction trade.

We suspect momentum will be absent and some fresh grinding would happen in the $ 64.00 – $ 65.20 range before the next trend sets in. Secondly, the next set of resistances are a bit far in the $ 67.00 – $ 68.00 range.

Therefore, ideally, a break below $ 64.00 would call for a resumption of the downtrend whereas a break above $ 65.20 / bbl would take us to the next resistance levels of $ 67.00 for a stronger pull back of the last drop.

Supports and Resistances

Pullback resistances are in the $ 64-65 / 67-68 area. Given the short term oversold nature of the commodity, pullbacks are expected as long as the low of $ 61.77 holds. Current levels were a target range last week. A more complete pullback may extend to $ 67-68 levels. We would suggest selling there.

Supports lie in the $ 61-62 range and then below at $ 58-59 range. For now, they are expected to hold resulting in a sideways move.

Naphtha

Asia’s naphtha crack rose for the third straight day to reach a near two-week high of $78.18 a tonne on Thursday following a series of spot and term demand.

Japan’s Mitsubishi Chemical has bought a cargo for first-half April delivery in the previous session, with levels estimated at a slight premium to Japan quotes on a cost-and-freight (C&F) basis. There were several term tenders issued by buyers including Singapore’s PCS, China’s Unipec, South Korea’s Lotte Chemical and Taiwan’s Formosa. Japan imported around 1.39 million tonnes of naphtha in January, the highest in three years.

The March crack has eased to $ 0.15 /bbl

Gasoline

Gasoline refining margins in northwest Europe regained some ground on Thursday amid sliding crude oil futures and still-strong demand in West Africa. Demand was somewhat precarious, with limited exports to the United States due to high stocks in that region. Gasoline stocks in independently held storage in the Amsterdam-Rotterdam-Antwerp hub rose by nearly 11 percent to their highest since July 2016, data from Dutch consultancy PJK International showed on Thursday. Exports to West Africa had slowed over the course of the week, while some unusual imports had arrived in ARA from Russia.

The March 92 Ron gasoline crack has jumped t0 $ 11.40 /bbl

Distillates

Asia’s jet fuel cash premium remained firm on Thursday, at $1.10 a barrel, after rising to the highest in more than five years on strong fundamentals.

Japan’s strong demand for kerosene, used for heating, this year has tightened supplies. Japan’s kerosene stocks, for instance, fell 990,000 barrels to 8.02 million barrels in the week to Feb. 10. The levels were nearly 1.6 million barrels lower than a year ago. To obtain more kerosene, refiners need to reduce the amount of jet fuel yield and this in turn would shrink jet fuel supplies. This has resulted in limited offers of jet fuel in the Singapore cash market despite a string of bids recently.

The March paper gasoil crack has increased to $ 13.95 /bbl. The 10 ppm crack is at $ 14.60 /bbl. The March regrade is has gone even higher to $ 1.60 /bbl today. We would recommend hedging the same.

Hedge Recommendations with current values in Red

March Regrade $ 1.40 ($ 1.60)

Fuel Oil

Asia’s front-month visco spread climbed to an eight-month high on Thursday after steady gains this week. The March visco spreads, the price differential between 180-cst and 380-cst fuel oil, climbed to $6.75 a tonne on Thursday, up from $5.75 a tonne at the end of the previous week. Some buying interest for 180-cst fuel oil cargoes in the Singapore trading window helped lift cash premiums of the fuel over recent weeks. .

The March 180 cst crack is unchanged at -$ 3.65 /bbl. The visco spread stays at $ 0.95 / bbl.

Hedge Recommendations with current values in Red

March -$ 3.00 (-$ 3.65)

2Q2018 -$ 2.80 (-$ 3.60)

3Q2018 -$ 2.40 (-$ 3.20)

4Q2018 -$ 2.05 (-$ 2.70)

1Q 2019 -$ 2.35 (-$ 2.70)

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity