Crude Oil

Oil prices rose 4.5% a barrel on Wednesday to their highest level in more than a month after U.S. crude inventories shrank and as major producers cut nearly a third of offshore Gulf of Mexico production ahead of an expected storm. Brent crude futures settled at $67.01 a barrel, up $2.85. WTI crude futures settled at $60.43 a barrel, climbing $2.60.

Both benchmarks hit their highest prices since late-May. A storm expected to form along the Gulf of Mexico also helped oil prices.

Major oil firms began evacuating and halting production from 15 offshore platforms in the Gulf of Mexico ahead of the storm, which is forecast to become a hurricane by the weekend. The Gulf of Mexico is home to 17% of U.S. crude oil output.

Treasury Secretary Steven Mnuchin in recent days urged US suppliers of Huawei Technologies Co. to seek licenses to resume sales to the blacklisted Chinese firm, reflecting the Trump administration’s recent reversal on Huawei.

India’s monsoon rains, which are crucial for farm output and economic growth, in the week ending on Wednesday were above average for the first time since the start of the season on June 1, helping farmers to accelerate the planting of summer-sown crops and easing concerns of drought

doe data

The DOE reported another massive draw of 9.5 million barrels of crude stocks this week, more than the figure reported by API and far more than expectations.

Also in consonance with the API, Gasoline stocks drew marginally while distillate stocks showed a healthy build.

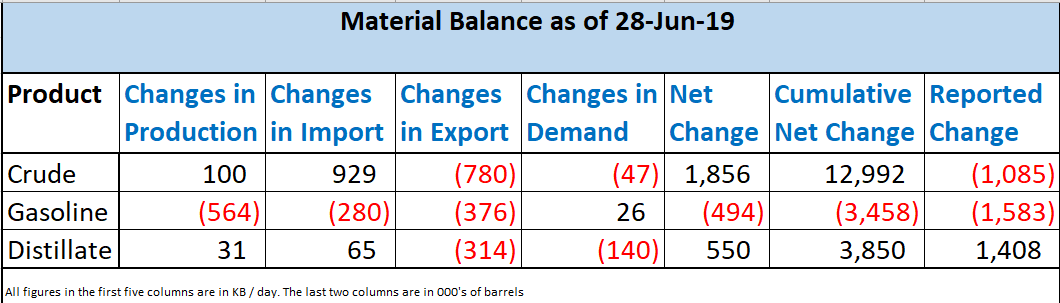

This is the fourth consecutive draw in crude stocks of which two were close to 10 million barrels. However, we confess to being puzzled by the last couple of draws. Our material balance statement below shows a far smaller draw of 2.7 million barrels

In our report on DOE stocks last week, our material balance statement (reproduced below) actually reported a build of 12 Million barrels in crude stocks. This divergence will inevitably have to resolve itself resulting in a big build at some point in time.

Naphtha

Asia’s naphtha crack reached a two-month high of $38.73 a tonne on Wednesday.

Vietnam’s Nghi Son oil refinery is being restarted, more than a week after the plant’s fluid catalytic cracking unit went down, disrupting operations at the 200 kbpd facility. This came at a time when there are other production cuts taking place in pockets of Asia due to maintenance or reductions caused by unworkable margins.

The July crack is unchanged at -$ 5.35 /bbl

Gasoline

Asia’s gasoline margins hit a 2-1/2 month high of $7.08 a barrel, supported by supply disruptions in Asia and strong demand in the West.

Demand for European gasoline from the United States was also strong following the massive fire at Philadelphia Energy Solutions last month.

Light distillate stocks in Fujairah rose by 121 KB to 7.32 million barrels in the week ended 8th July.

The July crack is higher at $ 8.80 / bbl

Click Here for a graphical depiction of Global Gasoline stocks by region.

Distillates

Cash differentials for gasoil with 10ppm sulphur content were at a discount of 17 cents a barrel to Singapore quotes on Wednesday, as against a 25-cent discount on Tuesday.

Middle distillate stocks in Fujairah rose by 630 kb to 2.18 million barrels in the week ending July 8.

Cash premiums for jet fuel rose to 23 cents a barrel to Singapore quotes on Wednesday, helped by firmer trading activity in the physical market. Jet premiums were at 17 cents a barrel to Singapore quotes on Tuesday.

The July/August time spread for jet fuel , which has stayed in backwardation since last week, traded at 13 cents a barrel on Wednesday.

Persistent tightness in the Mediterranean and Northwest European jet market amid the high-demand summer season has prompted refiners to maximize jet production over diesel. Some sources are expecting the pressure to remain until August.

US airlines’ jet fuel consumption reached its highest level of 2019 in May, Bureau of Transportation Statistics data showed Wednesday. Summer flying season started strong as last month’s usage was the most since August 2018.

The July crack for 500 ppm Gasoil has jumped to $ 15.05 /bbl with the 10 ppm crack at $ 15.75 / bbl. The regrade is at +$ 0.45 /bbl

Click Here for a graphical depiction of Global Distillate stocks by region.

Fuel Oil

Strong demand for cargoes of 380-cst fuel oil propelled Asian cash premiums of the fuel to a new 7-1/2 year high on Wednesday, while supply concerns also provided support.

Cash premiums for 380-cst HSFO jumped to $16.80 a tonne to Singapore quotes, their highest since January 2012 and up from $12.89 a tonne in the previous session.

Heavy distillate stocks in Fujairah rose marginally by 30 kb to 9.87 million barrels in the week ended July 8.

The July180 cst crack is at an incredible high of $ 7.80 / bbl with the visco spread at $ 0.65 /bbl.

Click Here for a graphical depiction of Fuel Oil stocks by region.

Hedge Recommendations

The strength in the fuel oil cracks is almost unbelievable with FO being more valuable than gasoline almost currently. While our existing hedges are deeply out of money, these massive jumps have to be extraordinary and prudent hedging requires us to hedge one more tranche of the August crack at $ 3.90 /bbl. We will also hedge the September FO crack at -$ 0.40 /bbl.

Similarly Gasoil has once again jumped up. We shall hedge the August, September and 4Q 10ppm cracks at current values of $16.40, $ 17.10 and $ 17.75 /bbl respectively.

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Click Here to see how all our recommendations have fared

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.