Crude Oil

Oil prices tumbled nearly 5% on Wednesday after an unexpected build in U.S. crude stockpiles. Brent crude futures settled $ 2.71 lower at $56.23 a barrel. WTI crude futures fell $ 2.54 to settle at $51.09 a barrel.

Last night’s settles have been the lowest since early January this year and have prompted talk that Saudi Arabia was mulling options to halt crude’s descent, alongside other producers.Consequently, both benchmarks then traded more than $1 higher than their settlement in the after-market, with Brent at $57.42 a barrel and WTI at $52.35 by early morning. There were reports that Saudi officials were considering all options to stop the drop in oil prices, and that they believe the fall has been caused by fears of an economic slowdown, not an oversupply of crude.

China’s rare earths association said it would support Chinese counter-measures in the escalating trade row with the United States, which it accused on Wednesday of unilateralism, protectionism and “trade bullying behavior”.

doe data

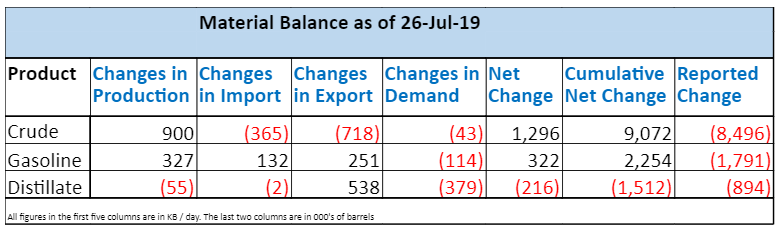

The market seemed to have been caught by surprise by the build of 2.4 million barrels in U.S. crude stockpiles last week, instead of the 2.8 million-barrel draw analysts had expected. We have to say that we had predicted a build this week in our OPD of 1st August as our Material Balance Sheet had suggested a huge build rather than a huge draw. Below is a snapshot of that Sheet.

The replenishment of stocks may have been aided by an acceleration in crude-by-rail shipments out of Western Canadian where crude oil inventories fell in July to 27.7M bbls as of July 26, down sharply from the record high of 37.1M bbls set in April. These levels are nearly two year lows.

Our Material Balance statement (shown below) this week still suggests an under reporting of crude stocks

Both gasoline and gasoil are showing their highest seasonal levels in the Gulf Coast. The matter of concern emanating from the material balance statement is the stagnation of demand suggesting that there is no likelihood of a shortfall in supplies in the near future.

Naphtha

Asia’s naphtha crack fell for the fourth straight session on Wednesday to hover near a six-week low of $21.85 a tonne, as buyers remained on the sidelines in view of falling oil prices.

The August crack is lower at -$ 6.75 /bbl

Gasoline

No fresh news on the gasoline market. Light distillate stocks in Fujairah fell by 31 kb to 7.69 million barrels

The August crack is lower at $ 6.95 / bbl

Click Here for a graphical depiction of Global Gasoline stocks by region.

Distillates

Cash differentials for the benchmark gasoil grade with 10 ppm sulphur content were at a premium of 4 cents a barrel to Singapore quotes, up from 3 cents per barrel a day earlier.

Cash premiums for jet fuel narrowed by 3 cents to 12 cents a barrel to Singapore quotes on Wednesday, dropping for the sixth consecutive session.

The jet differentials would likely continue to weaken over the coming weeks as late summer travel demand drops and regional refineries ramp up production to bring more supplies. Further keeping the jet fuel market in check is weaker air freight demand in the region that has come under pressure due to the ongoing U.S-China. Asia-Pacific airlines posted a drop of 5.4% in air freight demand in June, compared with the same period a year ago, the International Air Transport Association (IATA) said in a statement on Wednesday.

Middle distillate stocks in Fujairah rose marginally to 2.11 million barrels.

The August crack for 500 ppm Gasoil is lower at $ 15.05 /bbl with the 10 ppm crack at $ 18.80 / bbl. The regrade is at $ 0.10 /bbl

Click Here for a graphical depiction of Global Distillate stocks by region.

Fuel Oil

The backwardated near-term market structure of Asia’s 380-cst high-sulphur fuel oil (HSFO) dropped sharply on Wednesday, retreating from its recent record highs as concerns over intense supply shortages eased.

Broker sources pegged the 380-cst Aug-Sept and Sept-Oct time-spreads at about $13 per tonne and $15 per tonne, respectively, by the end of Asian trading hours. By comparison, the prompt-month Aug-Sept and the front-month Sept-Oct time-spreads in the previous session settled at premiums of $23.50 per tonne and $22.50 per tonne, respectively.

Despite weaker crude oil prices, the 380-cst HSFO barge crack fell to a 15-month low of minus $14.33 a barrel against Brent crude on Wednesday, down from $12.23 a barrel in the previous session.

Heavy distillate stocks in Fujairah rose by 1.09 million barrels to 9.52 million barrels

The August 180 cst crack has collapsed to – 4.95 / bbl with the visco spread at $ 1.25 /bbl.

Click Here for a graphical depiction of Fuel Oil stocks by region.

Hedge Recommendations

No fresh recommendations for today

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Click Here to see how all our recommendations have fared

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.