Crude Oil

Oil edged up on Tuesday, supported by a recovery in the equities market and on a technical bounce for crude after the biggest daily percentage drop in almost a year, but Brent futures stayed well below $70 a barrel. Brent futures gained 48 cents to settle at $68.12/bbl. WTI gained 50 cents to settle at $63.51/bbl.

This morning prices are slightly lower as the market still fears the backlash of a trade war and its impact on growth in China.

Overall, the outlook on crude remains bullish if we are to go by the bets laid by the Hedge Funds. Net long position in the 6 most important oil contracts stood at 1.39 billion barrels, not much lower than the record 1.48 billion barrels set on January 23rd this year. Further, long positions outnumber short positions by a record ratio of 12.5:1. (Source : Reuters)

While the associated risk of such skewed positions is well known, it does not seem to have fazed the funds from maintaining this sort of length virtually all through this year. Their belief that there is still significant upside stems from

- Venezuela’s output continues to fall as a result of internal unrest and mismanagement, while Iran’s exports are threatened by the possible reimposition of U.S. sanctions.

- U.S. shale output is rising rapidly but the rig count has levelled off in recent weeks, which some analysts have seen as a sign of increased capital discipline that should moderate further gains in production.

- At the same time, synchronised global growth and moderate oil prices are fuelling brisk growth in consumption, which is forecast to increase by more than 1.5 million barrels per day for the fourth year running.

The biggest source of uncertainty is now on the demand side, where the macroeconomic cycle is rapidly maturing, interest rates are rising, and increasing protectionism is clouding the outlook.

API Data

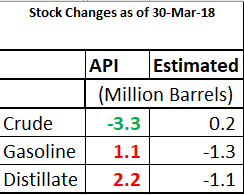

API reported a surprise draw of 3.3 million barrels, when analysts were expecting a build. Stocks in Cushing, however, built by 4.6 million barrels.

API reported a surprise draw of 3.3 million barrels, when analysts were expecting a build. Stocks in Cushing, however, built by 4.6 million barrels.

While this may have been bullish, the API also reported builds in Gasoline and Distillates where analysts had been expecting draws.

That this build in products was achieved with run rates falling 365 kb/d makes the picture even more confusing.

Markets will, as usual, be looking to the DOE for more clarity and official figures

Naphtha

Asia’s naphtha crack dipped by 2 cents $ 89.08 /MT. Spot premia were, nevertheless unchanged perhaps even stronger. There are reports of full range naphtha being purchased for 2nd half May delivery at a premium of $ 15-16 /MT.

The April crack for Naphtha has improved to – $ 0.05 /bbl.

Gasoline

Asia’s gasoline crack dropped 3 % to settle at $ 8.01/bbl on Monday. With high inventories in both Asia and Europe, CNPC reported a sale of a 35KT cargo destined for the American continent.

The April crack has slid below $ 11 / bbl to $ 10.90 /bbl .

Distillates

Asia’s jet fuel premiums climbed to the highest in over three weeks after some stronger bids on Tuesday. Cash differentials for jet fuel rose to 90 cents a barrel to Singapore quotes, from 52 cents on Monday. Jet markets will remain well supported at least until May but beyond that when refineries start coming back from the ongoing seasonal maintenance, the aviation fuel market may take a different stance

The premium for 10ppm gasoil fell to 39 cents a barrel to Singapore quotes, compared with Monday’s 50 cents, the highest so far this year. In the near-term gasoil would likely remain supported due to summer demand, but the market is trying to gauge whether the current stockpile of inventories, built over the last two quarters before the refinery turnarounds began, can get sufficiently drawn down.

The April gasoil crack is higher at $ 15.75 /bbl with the 10 ppm crack at $ 16.55 /bbl. The regrade has jumped to $ 0.80 /bbl.

Fuel Oil

Asia’s 180-cst fuel oil market extended gains amid concerns of narrow blendstock supplies over the coming month and ample inventories of high-viscosity fuel oil. Asia’s April viscosity spread climbed to its highest since June 2015 on Tuesday after nearly three weeks of steady gains, while cash premiums of the fuel rose to their highest in nearly six months. By contrast, ample supplies of the higher viscosity fuel weighed on 380-cst fuel oil cash premiums and time spreads.

The April 180 cst crack has firmed up to -$ 5.85/ bbl with the visco spread going wider to $ 1.75 /bbl.

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Today’s status of active recommendations is below.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.