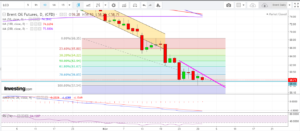

Crude Oil

Oil prices edged lower on Friday due to concerns of oversupply and a strong dollar but losses were limited by expectations that the OPEC and Russia would agree some form of production cut next week. Front-month Brent futures fell 80 cents to settle at $58.71 a barrel, ahead of expiry. The more active February Brent crude futures lost 45 cents to settle at $59.46 a barrel. U.S. crude dropped 52 cents to $50.93 a barrel.

For the week, Brent lost 0.2% while WTI snapped its losing streak to gain around 1%. Both WTI and Brent suffered their biggest monthly percentage declines in about a decade, losing approximately 22% in November, with surging supply and the specter of faltering demand scaring off investors.

Brent crude speculators cut their net long positions to the lowest level since 2015 in the week to 27th Nov according to ICE data.

Baker Hughes on Friday reported that the number of active domestic rigs drilling for oil rose by 2 to 887.

![]()

3 Dec2018

Naphtha

The naphtha crack to Brent crude climbed to a four-week high of $44.53 a tonne, up from $33.70 a tonne on Thursday. On Nov. 12, the naphtha crack had hit a more-than two-year low of $9.88 a tonne. Naphtha inventories held independently at the Amsterdam-Rotterdam-Antwerp (ARA) refining and storage hub jumped 28 percent to a three-week high of 258KT in the week to Nov. 29.

The December crack has improved to -$ 4.10 /bbl

Gasoline

The Singapore 92 RON gasoline crack against Brent crude moved back to a premium of $0.17 a barrel, a five session high and up from minus $0.83 a barrel on Thursday.

ARA Gasoline inventories rose 1 percent to a four-week high of 981 KT in the week to Nov. 29. Stocks were 11% higher than the same time last year.

The December crack has eased to $ 0.85 /bbl

Click Here for a graphical depiction of Global Gasoline stocks by region.

Distillates

Cash differentials for 10ppm gasoil widened their discounts by a cent to 44 cents a barrel to Singapore quotes on Friday, while the December/January time spread stood at a discount of 42 cents per barrel.

Asia’s refining margins for 10ppm gasoil fell fell to as low as $13.55 a barrel over Dubai crude during Asian trading hours, their weakest since early July. The margins were at $14.55 a barrel on Thursday.

The gasoil EFS was around minus $24 per tonne on Friday. At these levels, the arbitrage is still open. This should be supportive for gasoil cracks going forward.

ARA Gasoil inventories fell by 63 KT to 2.03 million tonnes. Inventories have now fallen below last year’s levels.

Cash differentials for jet fuel were at a discount of 75 cents a barrel to Singapore quotes, compared with a discount of 70 cents a barrel a day earlier. These are the weakest levels since October 3.

The December crack has improved to $ 13.20 /bbl with the 10 ppm crack at $ 13.95 /bbl. The regrade has eased to $ 2.45 /bbl

Click Here for a graphical depiction of Global Distillate stocks by region.

Fuel Oil

Cash premiums for Asia’s mainstay 380-cst high-sulphur fuel oil slipped to a 1-1/2 month low on Friday, weighed down by easing concerns of limited availability of finished grades of the fuel as inventories in the Singapore hub rose this week. Premiums for 380-cst cargoes slipped to $5.79 a tonne to Singapore quotes on Friday, from $6.24 in the previous session, and their lowest since Oct. 15..

Weekly fuel oil stocks in the ARA oil and storage hub fell by 133 KT near eight-month low of 904 KT in the week ended Nov. 29. ARA fuel oil inventories were 6 percent lower than year-ago levels but above the five-year average of 873,000 tonnes for this time of the year.

The December 180 cst crack has improved to +$ 2.60 / bbl with the visco spread at $ 0.60 /bbl

Click Here for a graphical depiction of Fuel Oil stocks by region.

Hedge Recommendations

No fresh comments as of now. We close out our December hedges as they are left to settle.

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Click Here to see how all our recommendations have fared

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.