Crude Oil

Oil prices edged higher on Wednesday as the U.S. Energy Information Administration (EIA) released its weekly inventory data which showed drawdowns in crude, gasoline and distillates. Brent settled at $52.36 /bbl, up 58 cents while WTI settled at $49.59 /bbl, up 43 cents.

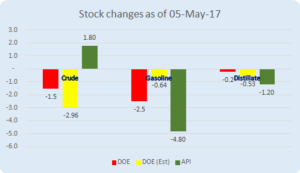

DOE Data

The US Weekly Petroleum Data released by the DOE for the week ending July 28, 2017 showed a decrease in crude, gasoline and distillate inventories. Commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.5 million bbls against an expected drawdown of around 3 million bbls. Total motor gasoline inventories decreased by 2.5 million bbls against an expected decrease of about 0.64 million bbls. Distillate fuel inventories decreased by 0.2 million bbls against an expected drop of approximately 0.53 million bbls. Inventories for crude, gasoline and distillates are in the upper half of the average range for this time of year.

Refineries operated at 95.4% of their operable capacity last week which is 1.1% higher than the previous week. This also led to a rise in crude oil refinery inputs which averaged 17.4 million bbls per day which is 123,000 bbls per day more than the previous week’s average. The total domestic production of crude oil was also up by 20,000 bbls per day at 9.4 million bbls per day. Over the last four weeks, crude oil production averaged about 9.42 million bbls per day, a considerable 10.9% above the same four-week period last year.

The U.S. crude oil imports averaged about 8.3 million bbls per day last week, up by 209,000 barrels per day from the previous week. On the other hand, U.S. crude oil exports averaged about 0.70 million bbls per day last week, down by 328,000 bbls per day from the previous week. This caused the net imports to rise by about 523,000 bbls per day from the previous week.

Total products supplied over the last four-week period averaged about 20.8 million barrels per day, up by 1.4% from the same period last year. Over the last four weeks, motor gasoline product supplied averaged about 9.8 million barrels per day, up by a mere 0.1% from the same period last year. Interestingly, distillate fuel product supplied averaged about 4.2 million barrels per day over the last four weeks, up by a significant 14.5% from the same period last year.

Naphtha

The fundamentals for the naphtha market remains strong as supplies are beginning to tighten on spot and term demand coming from South Korea, Japan and Malaysia. However cracks are lower today as an unexpected shutdown of a reformer at South Korea’s second-largest oil refinery operated by GS Caltex Corp has countered some of the impact coming from Shell’s Europe refinery outage.

The August crack is lower at $1.15/bbl.

Gasoline

Gasoline cracks have dipped marginally as traders apprehensions of a short term supply shortage in Europe due to the shutdown of the Pernis refinery was offset by Shell’s statement statement that its Pernis refinery may be back onstream by second-half of August.

The August crack is valued slightly lower at $ 12.40 /bbl today.

Distillates

Distillate cracks have stayed supported as the East-West arbitrage has opened. It is now profitable to ship jet fuel cargoes from the Middle East to Europe. However, increasing freight rates may limit cargoes shipped there. For now it is heard that two parcels of jet fuel totaling 100,000 mt and loading from Qatar and Kuwait respectively have been provisionally booked for Europe.

The August gasoil crack is unchanged at $ 14.05 /bbl. The regrade is at -$0.80 / bbl.

Fuel Oil

Fuel Oil cracks have dipped on the back of high inventories, poor demand and surplus supplies. Adding to the supply glut is Jordan Petroleum Refinery, a regular importer, which is looking to instead sell 60,000 to 70,000 mt of heavy fuel oil with 3.5 % sulphur content through a tender closing on 8-Aug.

The 180 cst August crack is lower at -$2.00 / bbl. The visco spread is at $0.80 /bbl.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity