Crude Oil

Crude oil prices settled at a two-week high on Friday, as geopolitical uncertainty in the Middle East raised the threat of supply disruptions, particularly in the wake of U.S. President Donald Trump’s refusal to certify Iran’s compliance with the nuclear deal. Brent settled 92 cents higher at $57.17 /bbl. WTI gained 85 cents to settle at $ 51.45 /bbl.

Both WTI and Brent posted impressive weekly gains of 4.4% and 2.8% respectively.

The uncertainty in the Kurdistan region, coupled with signs of increasing demand in China as well falling inventories in the US have all combined to be extremely supportive for crude.

Monday morning has seen some follow through action as crude has opened up with a gap at $57.80 / bbl. Commentators attribute this rise to the failure to certify coupled with a drop of 5 rigs as per Baker Hughes to 743.

Technical Analysis

Prices have bounced back smartly from the bottom of the rising channel in the daily chart keeping the rising channel intact. The weekly chart shows an engulfing bull candle for the last week indicating signs of bigger rises in the coming times ahead. Nevertheless, the top of the rising channel should serve as an effective resistance for the immediate future.

We see supports at $ 56.76, $ 56.00 and $ 55.00 for now with resistances at around $57.80, $58.47 and the recent high of $ 59.49 / bbl.

Naphtha

The Physical naphtha crack settle eased slightly yesterday to $ 102.33 / MT. Nevertheless demand for physical cargoes is still strong.

The paper cracks for October and November are both valued at a much firmer $ 3.15 /bbl.

Gasoline

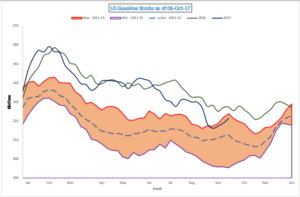

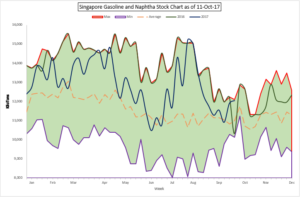

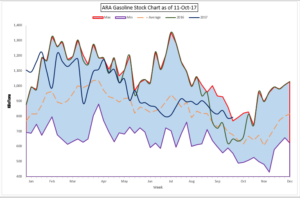

Gasoline inventories have increased across all the three major hubs viz. US, Singapore as well as the ARA region.

From the graphs above, it is pretty clear that Global gasoline inventories are pretty much near their highest for the current time of the year. With the driving season in the US coming to a close, only a warm winter can really help gasoline for now.

The October 92 Ron crack is valued lower at $ 11.05 /bbl while the November cracks is higher at $ 10.70 /bbl

Distillates

Distillate cracks have strengthened over the weekend.

The October gasoil crack is valued today at $13.15 /bbl. The November crack is valued at $ 13.25 /bbl. The regrade for October and November is valued at -$ 0.40 /bbl for and $ 0.20 /bbl respectively.

Fuel Oil

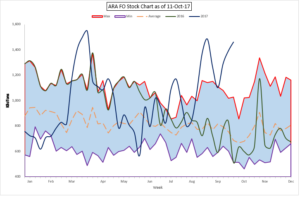

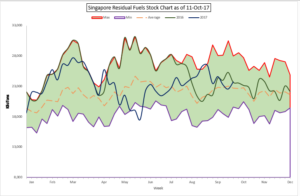

Fuel Oil cracks have given up strength over the week. Stocks have risen in Singapore and ARA last week.

While stocks is ARA are at their highest for this time of the year, stocks in Singapore have climbed above last year’s levels. The markets appear to have responded to that for now. However, the fuel oil market has been a very tricky market to call for the last year or thereabouts and crack levels of worse than – $ 3.00 /bbl have been rare enough to make buying seem a worthwhile strategy at those levels.

The October 180 cst crack is valued at -$2.60 / bbl while the November crack is valued at -$ 2.40 /bbl. The visco spread is valued at $ 0.60 /bbl for October and at $ 0.65 /bbl for November.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.

Disclaimer : All the views are the author’s personal views. These do not constitute an advice to buy or sell any commodity