Crude Oil

Crude oil futures ended the day / week / month / quarter strongly, largely in response to a drop in drilling activity in the US. The Brent May future expired 74 cents higher at $ 70.27/bbl. The June Future settled at $69.34/bbl. WTI futures gained 56 cents to to settle at $64.94/bbl.

U.S. drillers cut seven oil rigs in the week to March 29, bringing the total count down to 797 as per the weekly report of Baker Hughes.

The markets in general are very skittish anticipating additional sanctions on Iran. Funds, as at the end of the previous week held close to 12 long positions for every short position. This ratio is likely to have increased in the last week.

In other news, the Iraq oil minister said last week that OPEC and its partners may extend the supply cut through the first half of 2019. He said some members are suggesting a three-month extension, while others are suggesting six months.

Iraq also said it exported 3.453 mb/d of oil in March (+27 kb/d m/m). Exports were all from the southern and central fields, with no exports from the Kirkuk region.

![]()

Due to unavoidable circumstances a full technical view has been delayed. We present below an immediate view for our readers. A detailed view will be made available on our Technical Views Page later in the day.

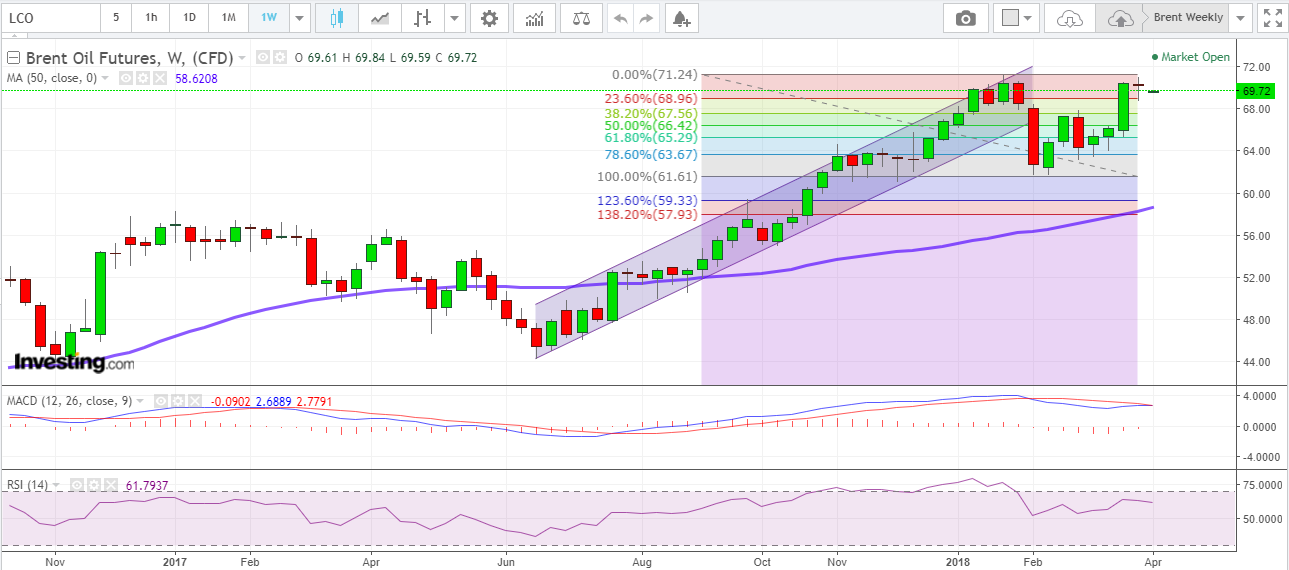

The daily and weekly charts seem to be giving mixed signals which is arguably typical of consolidation. The daily chart is showing bearish divergences with the MACD dropping even as prices rise. Prices were pulled back into the rising channel as an attempt to break out of it failed.

The weekly chart showed a spinning top for last week, but the MACD looks poised to cross over to the positive side, a bullish signal.

Tehcnically, prices seem to be virtually equidistant from both supports and resistance. So for the short term we would recommend waiting and watching. A position can be taken either to sell in the 70.25 -50 range with a stop above 71.30 or buy around 69.25 with a stop below 69.00.

Overall, the bullish trend remains intact with only a close below 65.50 really negating it.

Supports are at $69.00, $ 67.55-70 and $ 66.45-55

Resistances are at $ 70.55 and then $ 71.28

Naphtha

Asia’s naphtha front-month first-half May price was $13.25 a tonne higher versus first-half June, making this the widest intermonth spread since Dec. 20, as supplies tightened on demand and slow incoming cargoes from the West.

Cash premia for 1st half May delivery are now at $ 12- 12.50 /MT over CIF Japan quotes.

The April crack for Naphtha has however, gone down to – $ 0.20 /bbl.

Gasoline

Asia’s gasoline crack dipped slightly to $ 7.66/bbl on Thursday. High supplies in both Asia and Europe continue to weigh on prices in Asia notwithstanding the heavy draw in gasoline stocks in the US last week.

ARA Gasoline stocks rose to an all time high of 1.39 million barrels last week. Gasoline is being floated in both Europe and Asia

The April crack has also dropped to $ 11.55 /bbl .

Distillates

Asia’s jet fuel cash premium firmed on Thursday amid expectations of higher demand, while the front-month spread for the aviation fuel widened to its maximum in two weeks. Cash premiums for jet fuel increased to 46 cents a barrel to Singapore quotes, from 42 cents on Wednesday. The April-May jet spread widened to 59 cents a barrel, the highest since March 15. Jet fuel prices should benefit in the near term as the seasonal demand for summer travelling picks up pace.

Meanwhile, the cash differential of Asia’s 10ppm gasoil rose to 46 cents a barrel to Singapore quotes, from 42 cents on Wednesday.

ARA Gasoil stocks dropped by 260 KT to 2.69 million tonnes in the week to March 29

Global Distillate stocks continue to be tighten. This tightening could trigger a spurt in crack prices.

The April gasoil crack is higher at $ 15.70 /bbl with the 10 ppm crack at $ 16.44 /bbl. The regrade is up to $ 0.40 /bbl.

We would look to hedge the April Gasoil crack at around $ 16.00 /bbl if available in the next few days. However, we would be careful in light of the global stock situation.

Fuel Oil

Asia’s front-month viscosity spread climbed to a more than 10-month high on Thursday after nearly two weeks of steady gains. The strength in the viscosity spread, the price differential between 180-cst and 380-cst fuel oil swaps, came as a result of tighter blendstock supplies and steady demand for utility grades of the residual fuel. The April viscosity spread settled at $9.25 a tonne on Thursday, up from $9 a tonne in the previous session and its highest since May 4. in the week ended March 27

The April 180 cst crack is marginally higher at -$ 6.40/ bbl with the visco spread going wider to $ 1.50 /bbl

Hedge Recommendations

Hedge recommendations are essentially made for refiners. These are not trading positions as such. The rationale of these positions is to lock in extraordinary levels for the refiner.

Our Cal 19 Gasoil and Jet hedges look to be severely out of money. At these levels the nerve of a hedger is severely tested. Ordinarily, we would recommend adding to hedges at these levels. However, the strength in the prompt as well as the global gasoil stock situation suggests that we be cautious at this stage. Hence, we will wait a while before we add to our hedges.

As refiners, the loss on these hedges should not bother us as we would be recovering the same from our sale on the products next year.

Having said so, we have to make provisions for such losses today and hence we need to approach this aspect with caution.

Today’s status of active recommendations is below.

About this blog

This blog post attempts to give a top level summary of the Singapore market goings on to a person who seeks to obtain a directional sense of the market on a daily basis.